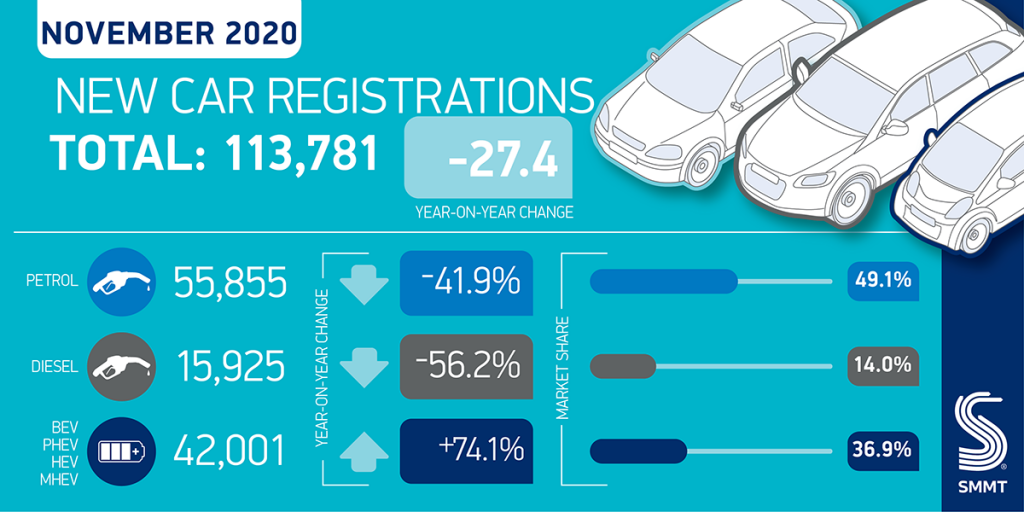

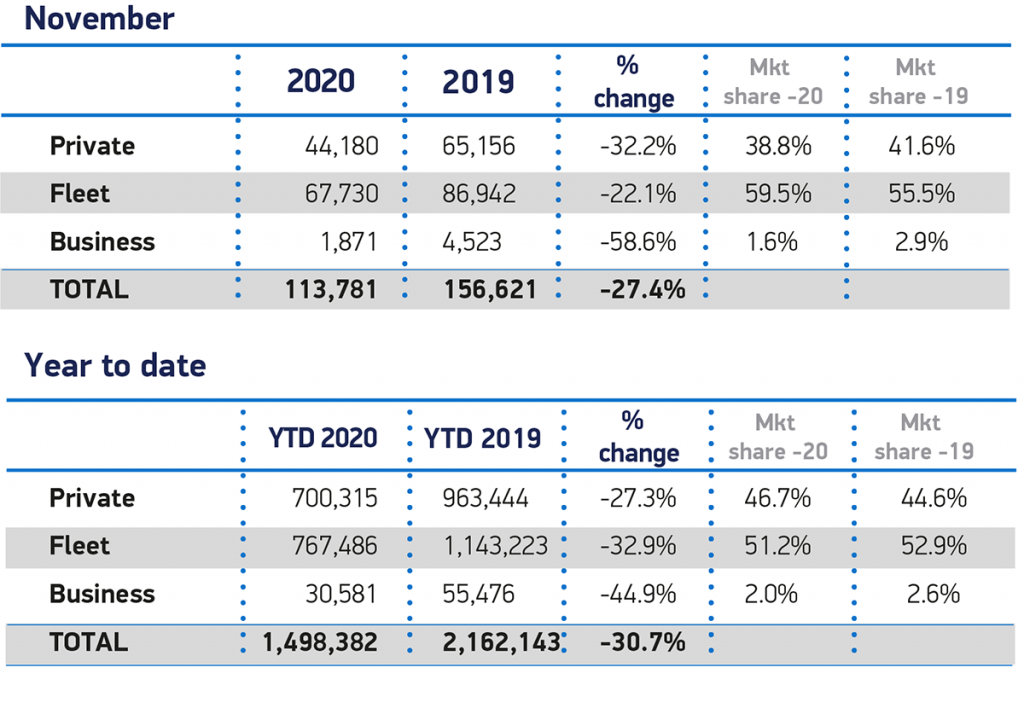

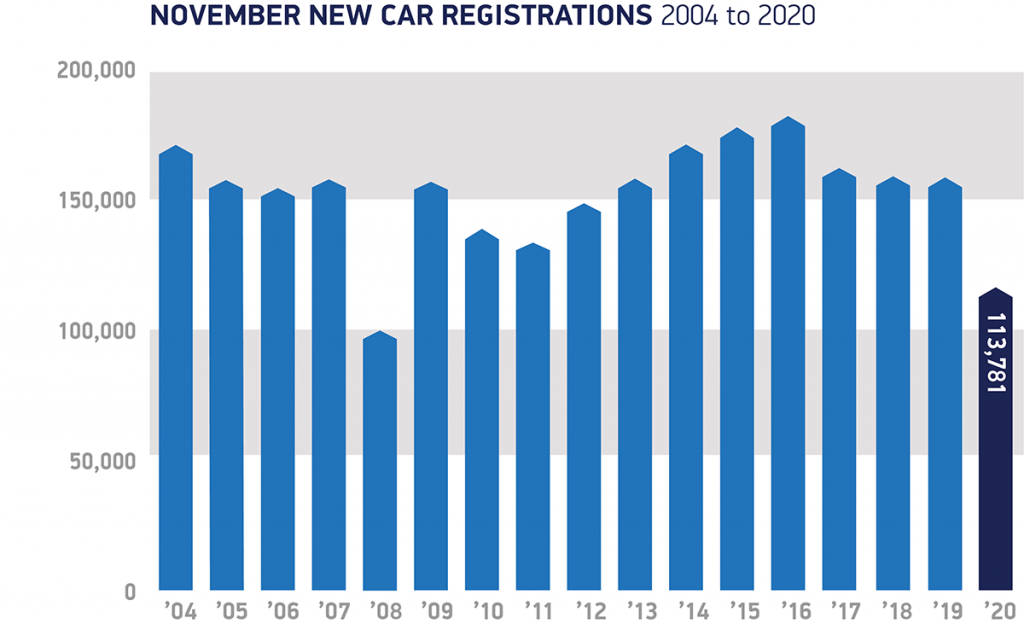

The UK new car market again saw a decline last month as registrations in November fell -27.4% year-on-year, or 42,840 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). In a month when showrooms across England had to close due to new lockdown restrictions, the industry recorded 113,781 new registrations, taking trade back to levels last seen during the 2008 recession.2

The decline was less severe than that seen during the first lockdown – when registrations fell by a record -97.3% in April alone – largely because this time around, retailers and manufacturers were able to be better prepared to fulfil orders via delivery or click and collect. Despite these innovations, private demand still fell by -32.2% while registrations by large fleets saw a decline of -22.1%

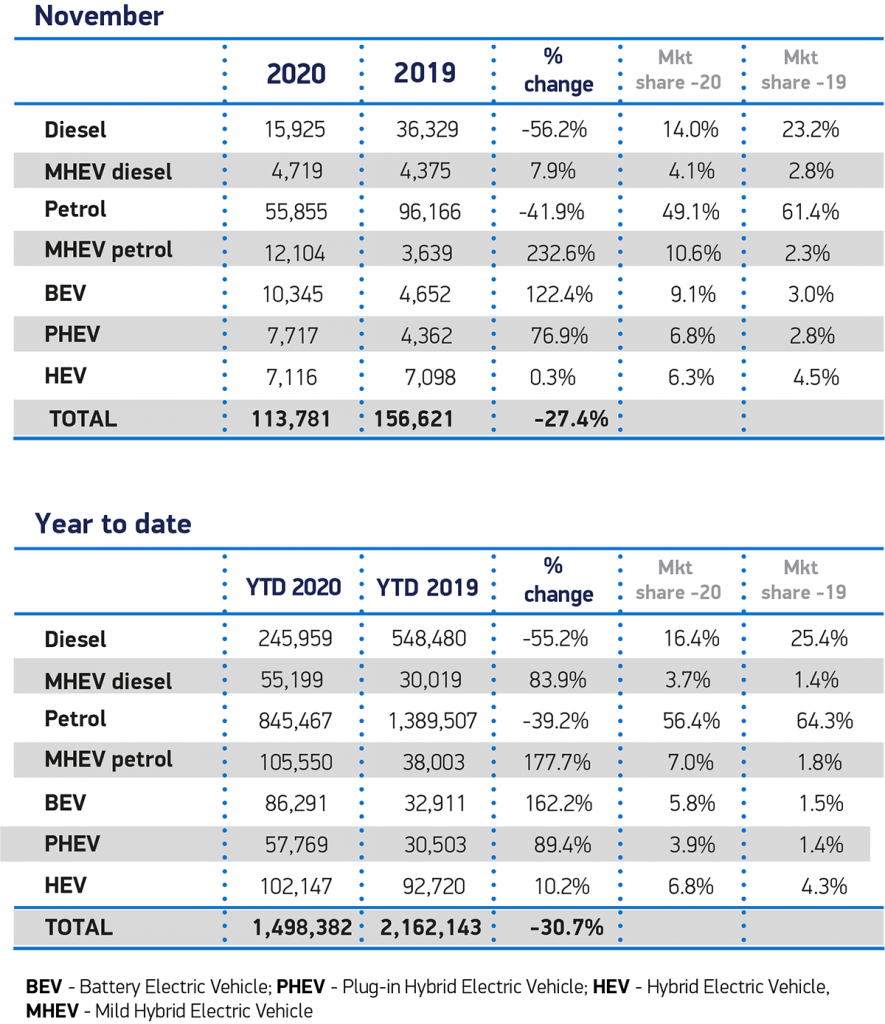

More positively, market share for battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) continued to grow significantly, up 122.4% and 76.9% respectively. BEVs recorded their third highest ever monthly share of registrations at 9.1%, while PHEV share increased to 6.8% – a combined total of more than 18,000 new zero-emission capable cars joining Britain’s roads.

Given the huge contribution that Covid-secure showrooms make to the economy and a national recovery, reopening dealerships across most of the UK will help protect jobs in retail and manufacturing and should help stimulate spending. The sector has lost 663,761 units to date in 2020, which means that around 31,000 cars would need to be registered every working day in December if the market was to achieve the level expected at the start of the year.3

Mike Hawes, SMMT Chief Executive, said, “Compared with the spring lockdown, manufacturers, dealers and consumers were all better prepared to adjust to constrained trading conditions. But with £1.3 billion worth of new car revenue lost in November alone, the importance of showroom trading to the UK economy is evident and we must ensure they remain open in any future Covid restrictions. More positively, with a vaccine now approved, the business and consumer confidence on which this sector depends can only improve, giving the industry more optimism for the turn of the year.”

Ashley Barnett, Head of Consultancy at Lex Autolease, said: “The continued decline in registrations is a concerning statistic for the motor industry. As showrooms closed their doors again following the second England-wide lockdown, consumer spending has continued to shrink with the short-term outlook remaining uncertain.

“The one positive is that the demand for electric vehicles continues to grow, despite the challenging circumstances. As the government confirms the ban on the sale of new ICE vehicles in 2030, the reality for businesses (and individuals) to make the shift is now much more pressing – based on typical four-year replacement cycles they’ll have just over two cycles to make the necessary changes.

“To keep up this momentum, government departments, manufacturers and industry bodies must come together to help accelerate the transition. A key part of this strategy must be ensuring there is a plan for the second-hand market for EVs. Without that, transitioning the 32m+ vehicles currently on the UK roads will be a challenge.

“Similarly, although the year-on-year increase in EVs is welcome, it’s important to remember that the total number of EVs, including PHEVs, on the UK’s roads still only accounts for 1.5% of vehicles. For pure EVs it’s lower still – less than half a percent. As the momentum shifts away from petrol and diesel vehicles, drivers need long-term reassurances that fiscal incentives and other perks such as congestion charge exemptions for zero emission vehicles will remain.”

Jon Lawes, Managing Director of Hitachi Capital Vehicle Solutions, said: “With the UK locked down for November, these latest figures make for sobering, yet unsurprising, reading. As with previous months, the only positive that can be seen is the continued growth in EV uptake YoY, of which HCVS has experienced first-hand.

“What November 2020 will be remembered for is the momentous announcement by the Government to bring forward the ban on fossil-fuel cars to 2030. By doing so they have challenged a diverse range of sectors, from energy to town planning, to collaborate, think creatively and invest in bringing about a transport revolution on the same scale of the growth of the railways over 200 years ago.

“In recent weeks we have seen a number of questions raised by detractors around the feasibility of the Government’s bold policy, but we should welcome the challenge. Ground-breaking partnerships such as the one we have with GRIDSERVE shows how private sector funding and innovation is supporting the ten-point plan.”

1 42,840 fewer cars than November 2019 at an average price from JATO of £30,000

2 2008 registrations:100,333

3 ~754,000 units across a six-day working week and excluding 25, 26 and 28 December 2020