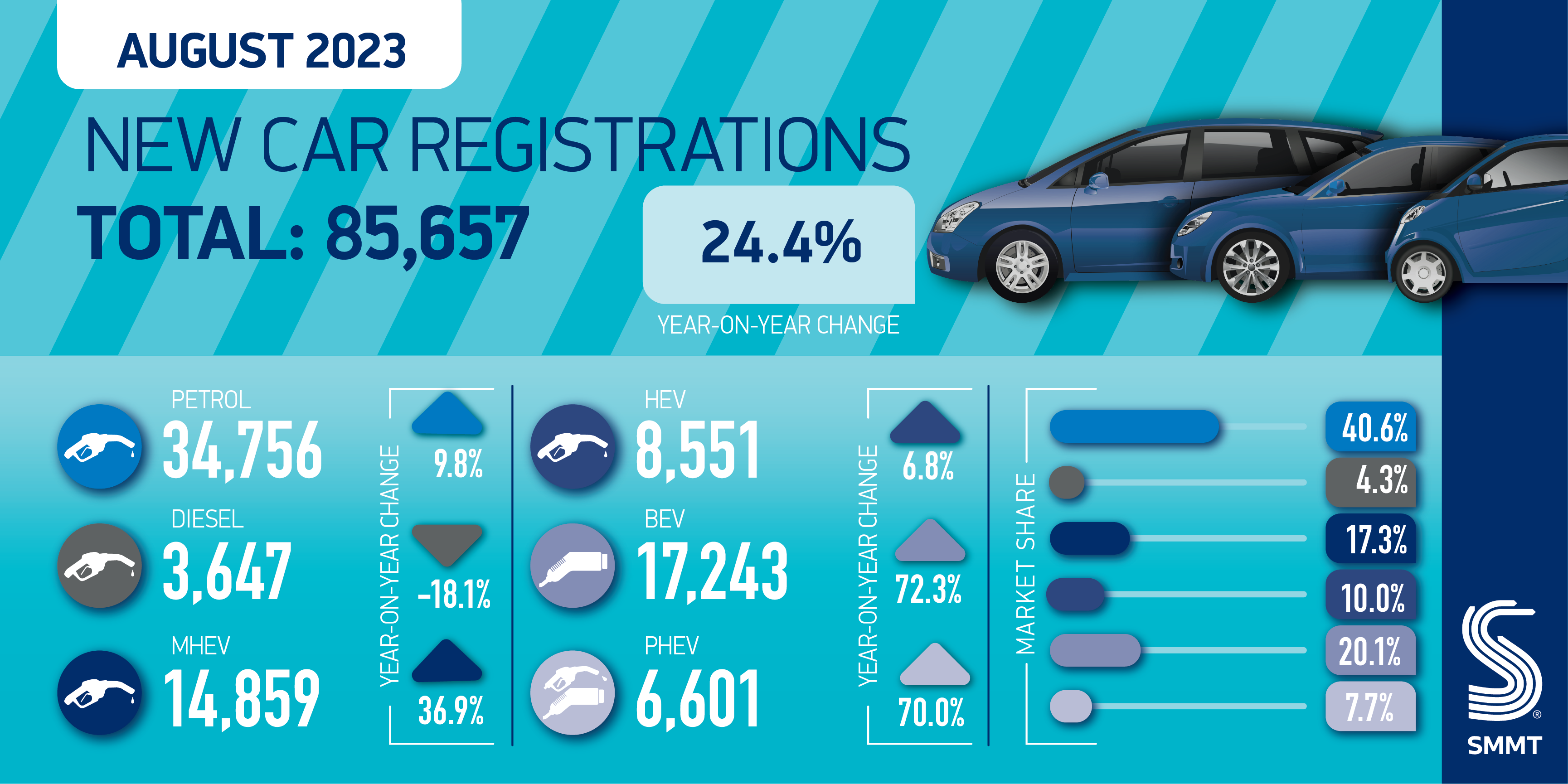

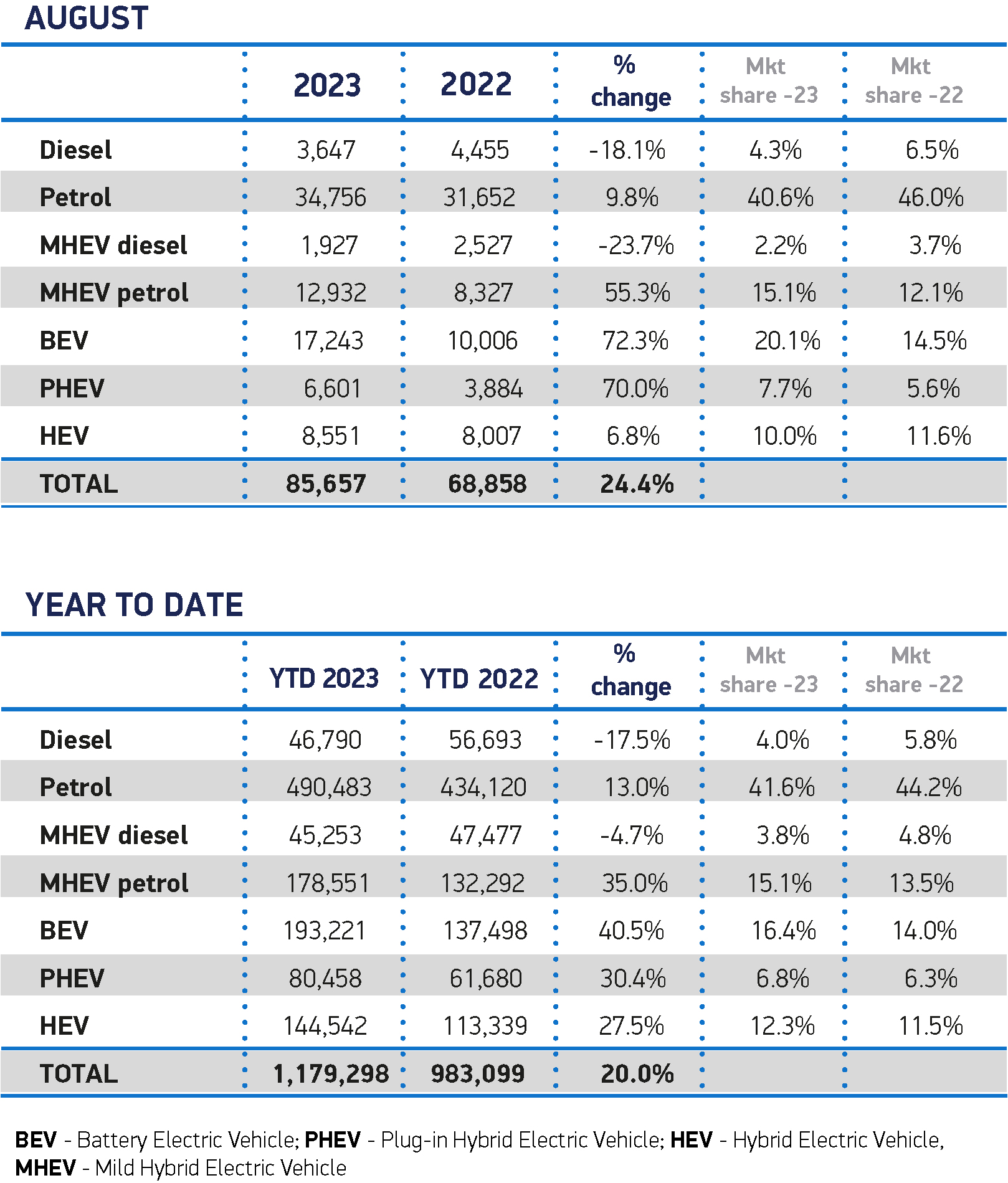

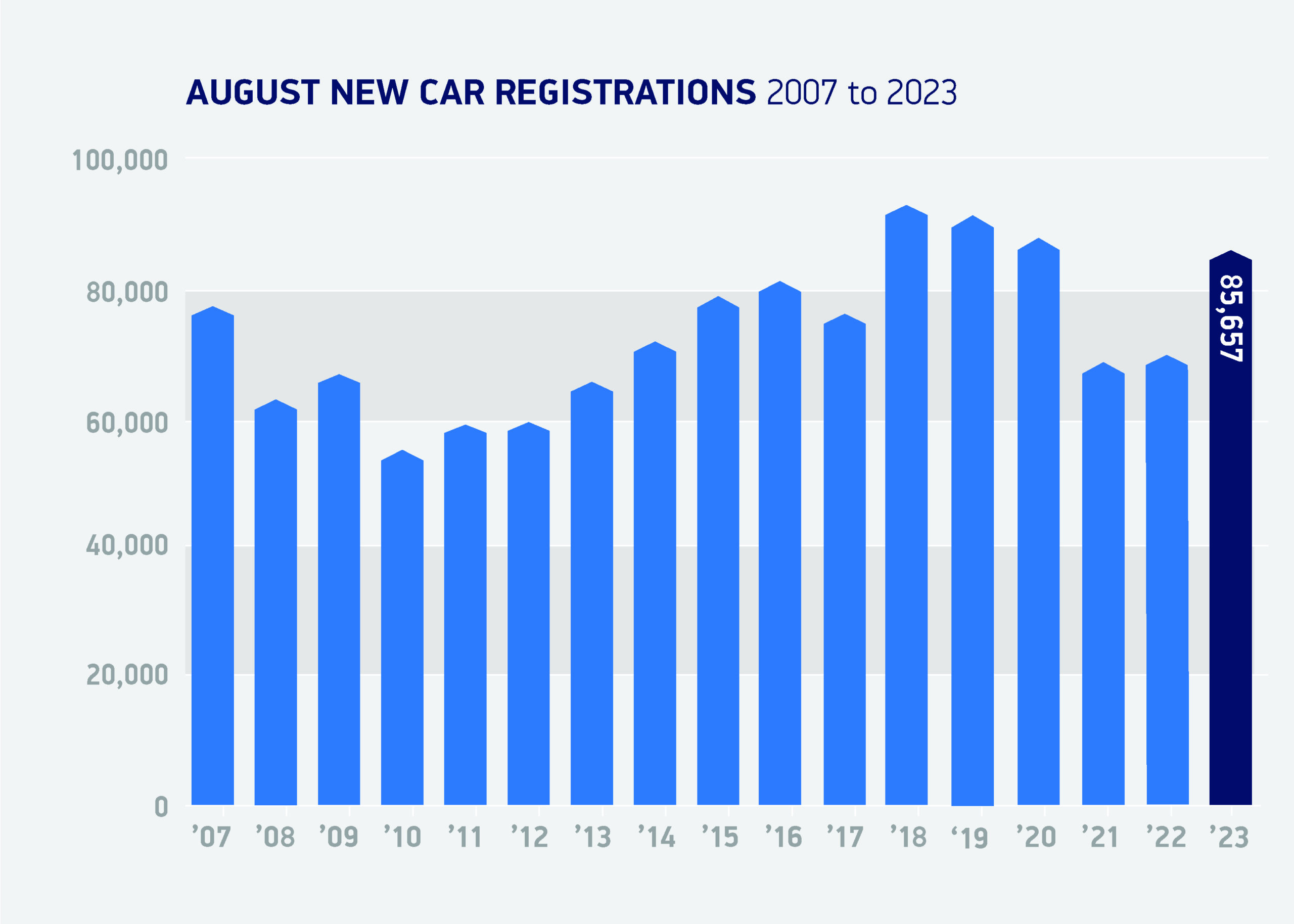

The new car market grew 24.4% in August with 85,657 new vehicles registered, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). While August is typically a quieter month with many buyers choosing to wait until the September numberplate change, an increase of 16,799 units means the sector is now entering a second year of growth. Despite this improved performance, the market still remains -7.5% below pre-pandemic levels.1

The increase was fuelled by a surge in registrations by large fleets, rising 58.4% to 51,951 units, while business registrations grew 39.4% to 1,635 units. Conversely, private demand softened by -8.1%, compared with a supply-constrained 2022 market.

Demand for electrified vehicles continued to grow, accounting for almost four in 10 (37.8%) new cars reaching the road. Battery electric vehicle uptake swelled by 72.3% to secure a 20.1% market share, an August record and the highest recorded since last December. Plug-in hybrid uptake also rose significantly, by 70.0%, to account for 7.7% of new registrations. Hybrid volumes remained relatively stable with a 6.8% increase, comprising 10.0% of the market.

However, with less than four months to go until the expected introduction of a Zero Emission Vehicle Mandate, industry still has no sight of the proposed regulation. The automotive sector is committed to Net Zero but the diminishing time threatens the ability of the market to move. Demand from both business and private consumers must be boosted still further if ambitions are to be met, but while businesses benefit from fiscal incentives to switch, there is no similar package for the private consumer market.

Mike Hawes, SMMT Chief Executive, said, “With the automotive industry beginning a second year of growth, recovery is underway with EVs energising the market. But with a new Zero Emission Vehicle Mandate due to come into force in less than 120 days, manufacturers still await the details. Businesses cannot plan on the basis of consultations, they need certainty. And now, more than ever, government must match action to ambition, ensuring there are the incentives and infrastructure in place to convince drivers to make the switch.”

Jon Lawes, Managing Director at Novuna Vehicle Solutions, said, “The priority now is for the Government to provide clarity on the ZEV mandate, to avoid stalling investment in charging infrastructure, and mitigate against potential supply issues if manufacturers impose caps on non EVs into the UK which could affect the wider economy, as consumers and the industry grapples with continued uncertainty.

“There is real support for the mandate across the industry, however the challenge is in the detail and with 2024 just around the corner, timing is everything.”

Nick Williams, Managing Director, Lex Autolease, part of Lloyds Banking Group, said, “Following last month’s stellar electric vehicle (EV) registration numbers, the transition to electric has seen further success as the summer comes to a close, with another 85,657 vehicles registered in August.

“Results from the government’s consultation on the Zero Emissions Vehicles mandate are set to be announced imminently, helping to map out the UK’s electric future and ensure we’re able to deliver on our commitment to net zero.

“It’s essential that the responses are used to build a robust mandate that paves the way for further investment and innovation in EVs and makes the UK an attractive place for manufacturers to launch and sell the electric models that will help meet our Net Zero targets. It’s also the hope of the industry that the mandate is firmly backed up with essential investment in the charging infrastructure and continued financial incentives that will encourage consumers to opt for a lower emissions vehicle.”

“Whilst August is traditionally a quiet for motor retail in the run up to September’s plate change, dealers are reporting a positive month for trading. New car sales continue to steadily increase year-on-year, driven by the electrification of the UK car parc.” said Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK commenting on the latest SMMT’s new passenger car registration figures.

In August, a total of 85,657 new cars were registered, an increase of 24.4% from the same period last year. Sales to private buyers fell by -8.1%; fleet registrations were up by 58.4%.

Battery electric vehicles (BEVs) experienced significant growth, up 72.3% to 17,243 units. Plug-in hybrid (PHEVs) registrations increased by 70% to 6,601 units, and hybrids (HEVs) followed with growth of 6.8% to 8,551 units. There are now 193,221 registered BEVs on the road in 2023 compared to the 137,498 at the same point last year, a 40.5% increase.

With sales of electric growing, diesel fell from 4,455 units to 3,647 (-18.1%), but petrol has risen from 31,652 units to 34,756 units (9.8%).

Sue Robinson added: “The top of the news agenda for the past month has been ULEZ, NFDA’s members have begun to see the impact of the legislation with increasing enquiries and growing interest about switching to electric from a non-ULEZ compliant car. Feedback from members is that footfall is steady, particularly in these zones, with prospective EV consumers keen to speak to their local retailers, who act as vital information hubs for their communities.

“Looking ahead, September is an important month in the industry and NFDA retailers are well prepared to meet the demands of UK consumers with good stock availability, high levels of training, through NFDA’s Electric Vehicle Approved accreditation, and a focus on delivering the best service possible to UK consumers.”

Caroline Litchfield, partner and head of manufacturing and supply chain at independent law firm Brabners, said, “Dealers have now enjoyed 13 consecutive months of growing new car registrations, with optimism that September’s plate change will help to buoy sales further through Q4 despite fragile consumer confidence.

“The shift to plug-ins continues apace, with it estimated that one new BEV will be registered every 50 seconds by the end of the year. Yet the infrastructure transition continues to lag behind. And plug-in drivers risk facing the misery of growing queues at charging points without bold new Government strategy and investment.

“The ULEZ expansion proved how divisive EV policy can be. So, ministers must prioritise producing a clear plan for the UK’s transition to cleaner transport to ensure that these promising figures remain consistent, instead of just a flash in the pan.”

John Wilmot, CEO, car leasing comparison website LeaseLoco, comments,“Although a 13th consecutive month of growth in new car registrations is grounds for cautious optimism, sales are still well adrift of pre-pandemic levels.

“Also, individual purchases in August were actually down compared to a year ago. It was company registrations rather than private registrations that powered growth last month.

“This is likely to continue to be the case in the second half of the year, as peoples’ finances are squeezed by inflationary pressures, high interest rates and the general cost of living.

“Electric vehicle registrations remain on a steady upwards path with market share rising above 20% in August, but still well below the 33% level seen at the tail end of last year.

“A fifth of all registrations are now BEVs according to the latest SMMT figures, but this still feels too low with less than seven years before the new petrol and diesel vehicles ban comes into force.

“Price and charging infrastructure remain a thorn in the government’s side. The demand is there to switch to electric but the high price of many EVs and concerns over the coverage and reliability of the charging network remain barriers to early switching.”

1 August 2019 registrations: 92,573