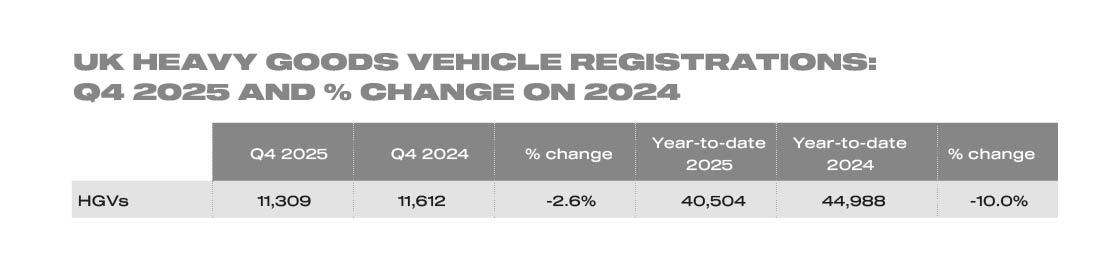

New HGV registrations declined by -10.0% in 2025 with 40,504 new trucks joining UK roads, according to the latest data published by the Society of Motor Manufacturers and Traders (SMMT). The market contracted every quarter last year, reflecting a challenging economic backdrop and a normalising of fleet renewal after three years of sustained post-pandemic growth.1

The contraction included reduced demand for tractor units, down -4.4% to 17,758 units – albeit softened by 6.9% growth in the fourth quarter – to represent two-fifths (43.8%) of the market. The box van segment saw the largest volume decline, down -28.1% to 3,949 registrations. Conventionally lower volume demand for tipper and curtain-sided trucks also fell, by -11.1% and -26.2% to 3,076 and 2,820 units respectively. There was, however, some good news as demand for new refuse disposal trucks rose 22.6% to 2,459 registrations.

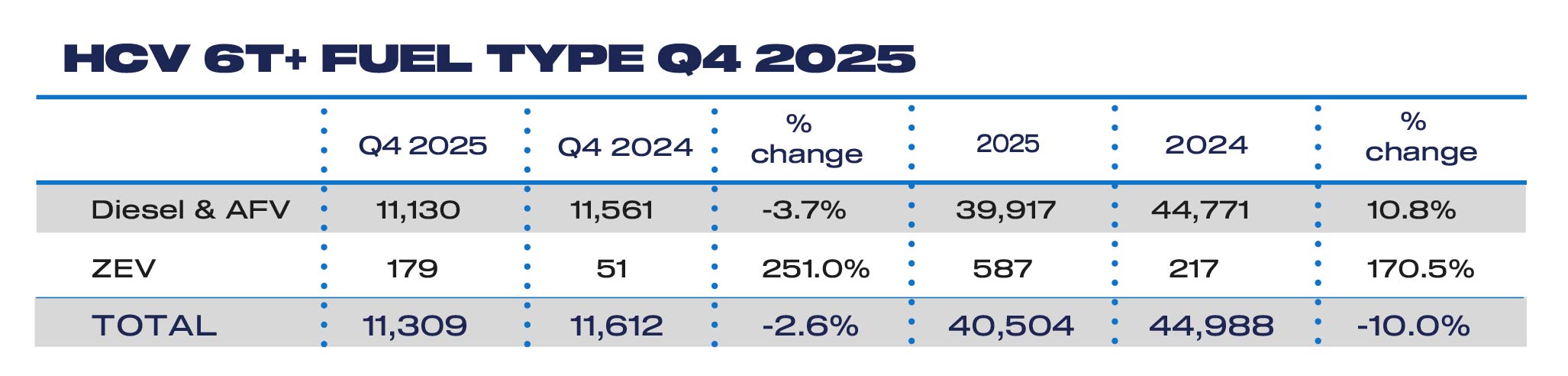

Also positively, new zero emission HGV uptake rose 170.5% year-on-year to reach 587 units – a new record boosted by a more than tripling in year-on-year demand in Q4, up 251.0% with 179 registrations. The UK has, as a result, surpassed the milestone of 1,000 new zero emission truck registrations – success driven by impressive product rollout, with 21 different models across a range of use cases registered last year, and enhanced public grants.2

Also positively, new zero emission HGV uptake rose 170.5% year-on-year to reach 587 units – a new record boosted by a more than tripling in year-on-year demand in Q4, up 251.0% with 179 registrations. The UK has, as a result, surpassed the milestone of 1,000 new zero emission truck registrations – success driven by impressive product rollout, with 21 different models across a range of use cases registered last year, and enhanced public grants.2

However, with zero emission trucks representing just one in every 71 (1.4%) new registrations, the market is still at the very beginning of early adoption. Operators face tight margins and uncertainty on how to integrate zero emission vehicles into their fleets, especially given delays of up to 15 years for depot-to-grid connections, which poses a major disincentive, with some operators facing depot-to-grid connection waits of up to 15 years.3

An improved Plug-in Truck Grant and the new Depot Charging Scheme announced last July will help more operators to switch, but they cannot commit to investment without the guarantee of timely infrastructure delivery. Prioritising road transport depots for grid connections is essential, therefore, with the same fast-tracked planning processes as data centres, wind farms and solar projects able to give more early adopters the clarity and confidence they need to transition.

An improved Plug-in Truck Grant and the new Depot Charging Scheme announced last July will help more operators to switch, but they cannot commit to investment without the guarantee of timely infrastructure delivery. Prioritising road transport depots for grid connections is essential, therefore, with the same fast-tracked planning processes as data centres, wind farms and solar projects able to give more early adopters the clarity and confidence they need to transition.

Mike Hawes, SMMT Chief Executive, said: “The new HGV market continues to normalise amid economic constraints on fleet investment, but a return to growth in 2026 is needed so that UK businesses can keep moving with the latest, cleanest vehicle technology. Innovative new models are helping to lift zero emission truck uptake but to unlock real growth, we need faster depot grid connections and planning approvals – only then can more operators invest and capitalise on the benefits of zero emission fleets.”

Russell Olive, UK Director, at charging management software provider, vaylens comments: “Stripping away the headline growth, just one in 71 new HGVs being zero-emission shows that the EV fleet transition is still operating at the margins.

“For operators shifting HGVs to electric, a successful transition starts with understanding how their trucks are actually used day to day, what energy they need back at the depot and which parts of the fleet can switch now versus later.

Businesses must make those decisions based on real operational data for the transition to become more manageable.”

Nyanya Joof, Head of UK at Motive, said: “The 2025 decline in HGV registrations represents the tough climate organisations that manage fleets are facing: balancing rising costs, driver shortages, and ongoing uncertainty around fuel and insurance. In moments like this, operational efficiency becomes more than a priority – it becomes a lifeline.

“These challenges are compounded by the pressures affecting drivers on a day-to-day basis, from long journeys to incident risk. We found that behaviours such as distraction and fatigue – often exacerbated during high‑stress periods – are key contributors to collisions.

“To protect both people and margins, organisations need AI that help prevent unsafe driving in the moment, keep drivers compliant and road-ready, automate time-consuming administrative work, and provide real-time insights to make smarter operational decisions – from rerouting around severe weather to proactively reducing risk. In a climate where every vehicle, every driver, and every mile counts, AI must deliver measurable improvements in safety, uptime, and efficiency – so fleets can operate with confidence today and invest in the future.”

1 Full-year new HGV registration totals: 2021: +12.9%; 2022: +9.6%; 2023: +13.5%; 2024: -2.7%.

2 1,166 ZEV HGV registrations (above six tonnes) on record

3 DESNZ, 15 April 2025