The transition to electric vehicles has gone far beyond environmental benefits to positively impacting the bottom line of commercial fleets, according to new research released today.

EO Charging

An in-depth survey of 300+ senior decision-makers responsible for the electrification of 100+ vehicle sized fleets (cars, vans, medium and heavy-duty trucks, buses and specialist vehicles) across the UK and US, has revealed that 43% anticipate reduced total cost of ownership as a result of their transition to electric.

The study, conducted by Vanson Bourne in conjunction with EO Charging, a global pioneer in electric vehicle (EV) charging solutions, also revealed that more than half (53%) of organisations’ fleets are now electrified on average, five years out from the 2030 deadline for the phase out of petrol and diesel vehicles.

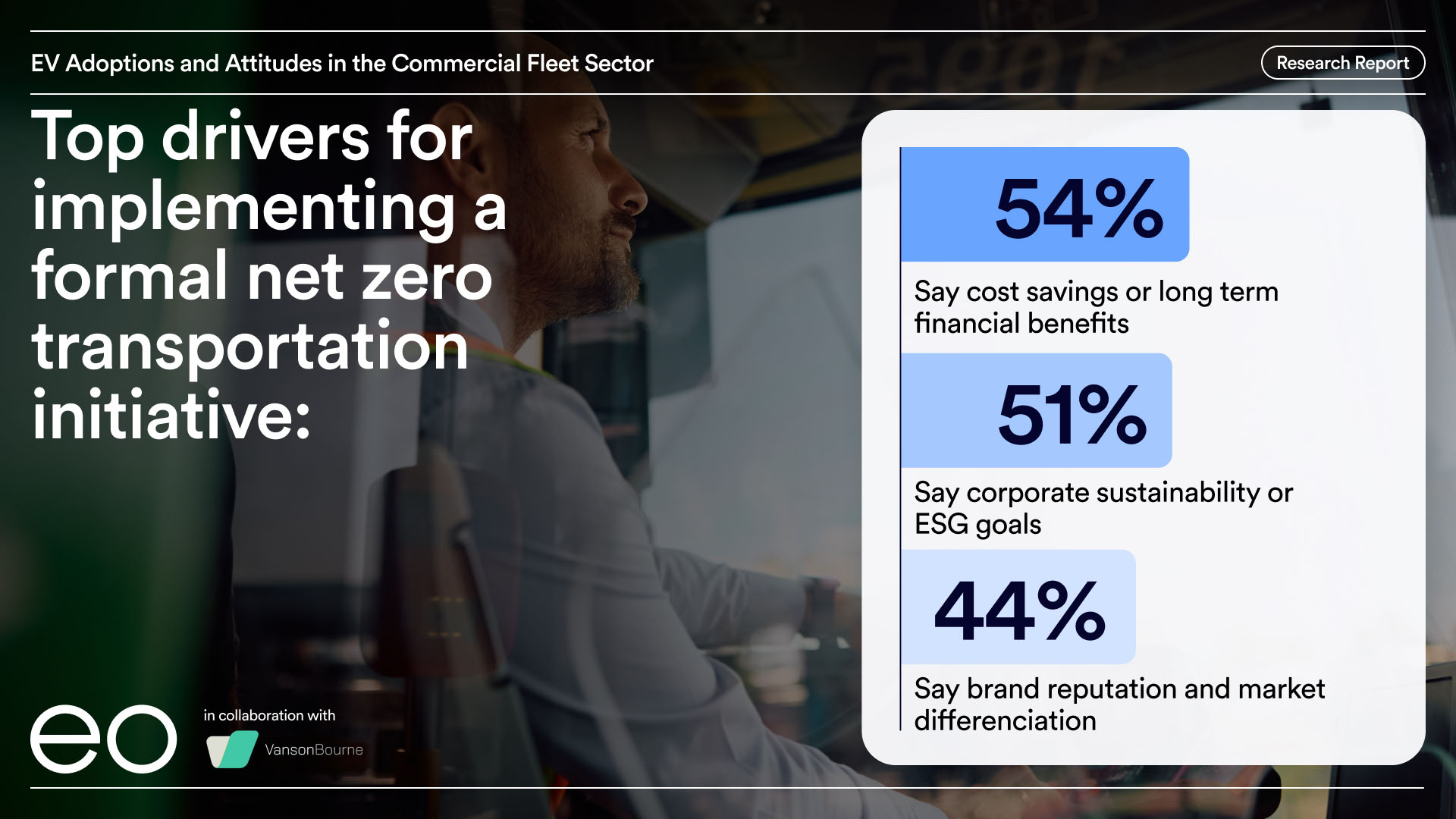

A commitment to sustainability is also evident, with the majority (84%) of organisations having already at least partially introduced a net-zero transportation initiative, with over half (54%) pointing to cost savings / long-term financial benefits as the primary driver for this.

When breaking this down further, public sector organisations are more than twice as likely to have a fully implemented net zero transportation initiative (47%) than their counterparts in the private sector (23%).

Richard Staveley, CEO at EO Charging, commented: “This research clearly highlights that commercial fleet electrification has now evolved from what was once primarily a legislative led initiative to meet environmental targets to a mainstream business strategy. Driven by seeing tangible cost efficiencies, organisations across multiple industries have long moved beyond small trials and pilot schemes to embrace electrification as a transformational business benefit.”

However, while momentum around electrification is strong, the research also reveals challenges for fleet operators to overcome, including changing governmental policies. Eight in ten organisations (81%) surveyed said that policy fluctuations are undermining their ability to develop long-term electrification strategies, while over half (54%) are not planning beyond the current administration in their respective markets.

EO Charging

Uncertainty around energy markets and rising global tensions are further impacting long term planning amongst UK commercial vehicle fleets, with 88% of respondents saying fluctuations in energy price make it harder to prove the financial case for the transition to electric. Meanwhile, 80% of UK respondents pinpointed global tensions as raising risks around sourcing critical components such as EV batteries.

Richard Staveley added: “Fleet electrification has reached a pivotal inflection point, as businesses seek further clarity at a governmental level to plan for the long-term and maximise the benefits they’ve seen from initial EV adoption. In the UK, the government’s Industrial Strategy marks positive steps in this direction with clearer mandates around policy timelines and decarbonisation targets. However, to scale with confidence businesses should make sure they are engaged with industry bodies, work closely with manufacturing and energy partners, and frequently review government guidance. Working in a collaborative manner will help ensure fleets are best poised to scale efficiently and realise the full promise of electrification.”

EO Charging serves some of the world’s largest fleet operators, including Amazon, DHL, UPS, Tesco, GoAhead, Stagecoach and FedEx. In November 2025, the company announced a £25m shareholder-led recapitalisation, combining an increased debit facility with HSBC and a new equity injection from existing investors, Zouk Capital and Vortex Energy.

To access the full report, visit: http://www.eocharging.com/stories/ev-adoption-and-attitudes-in-the-commercial-fleet-sector