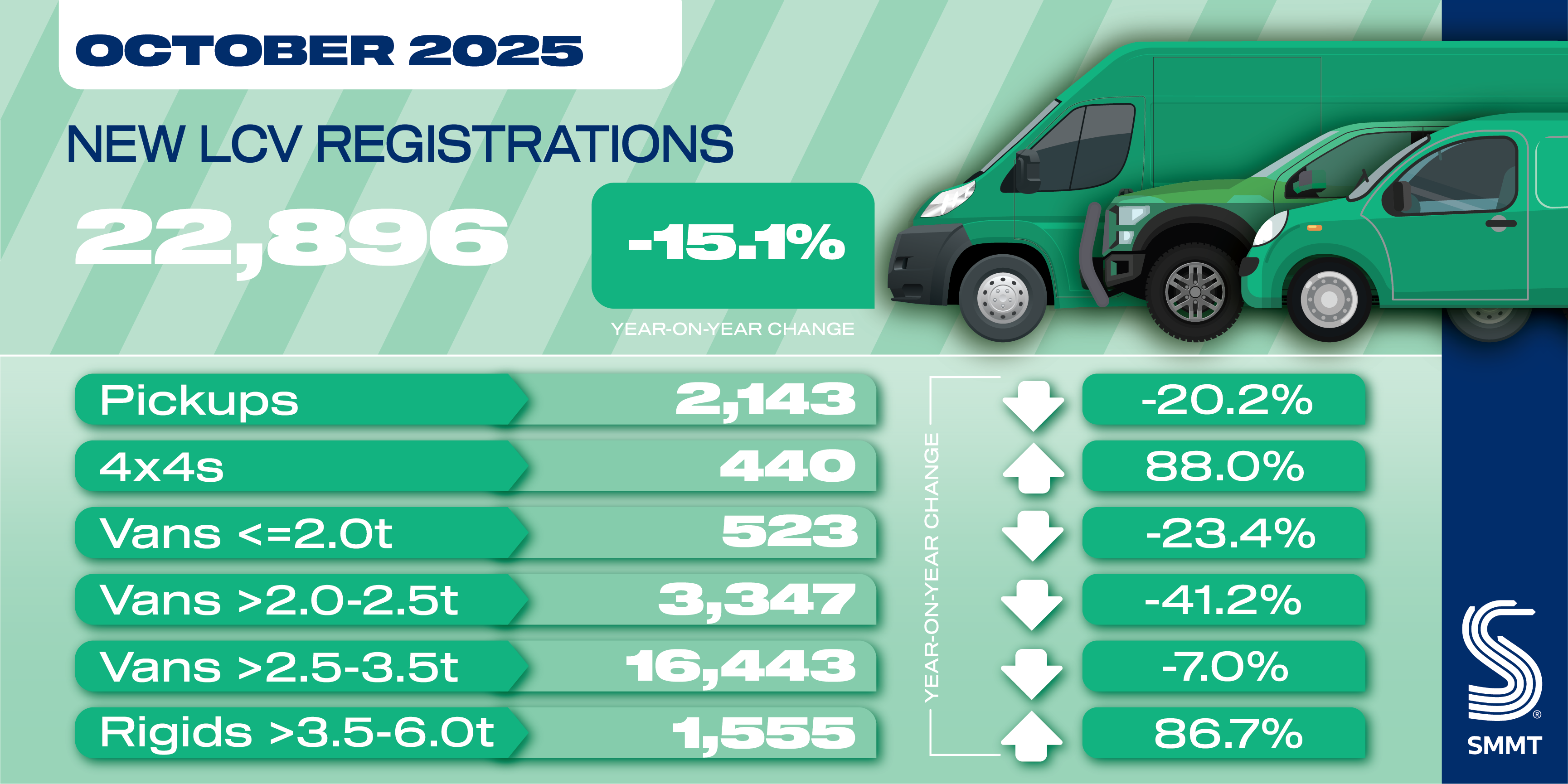

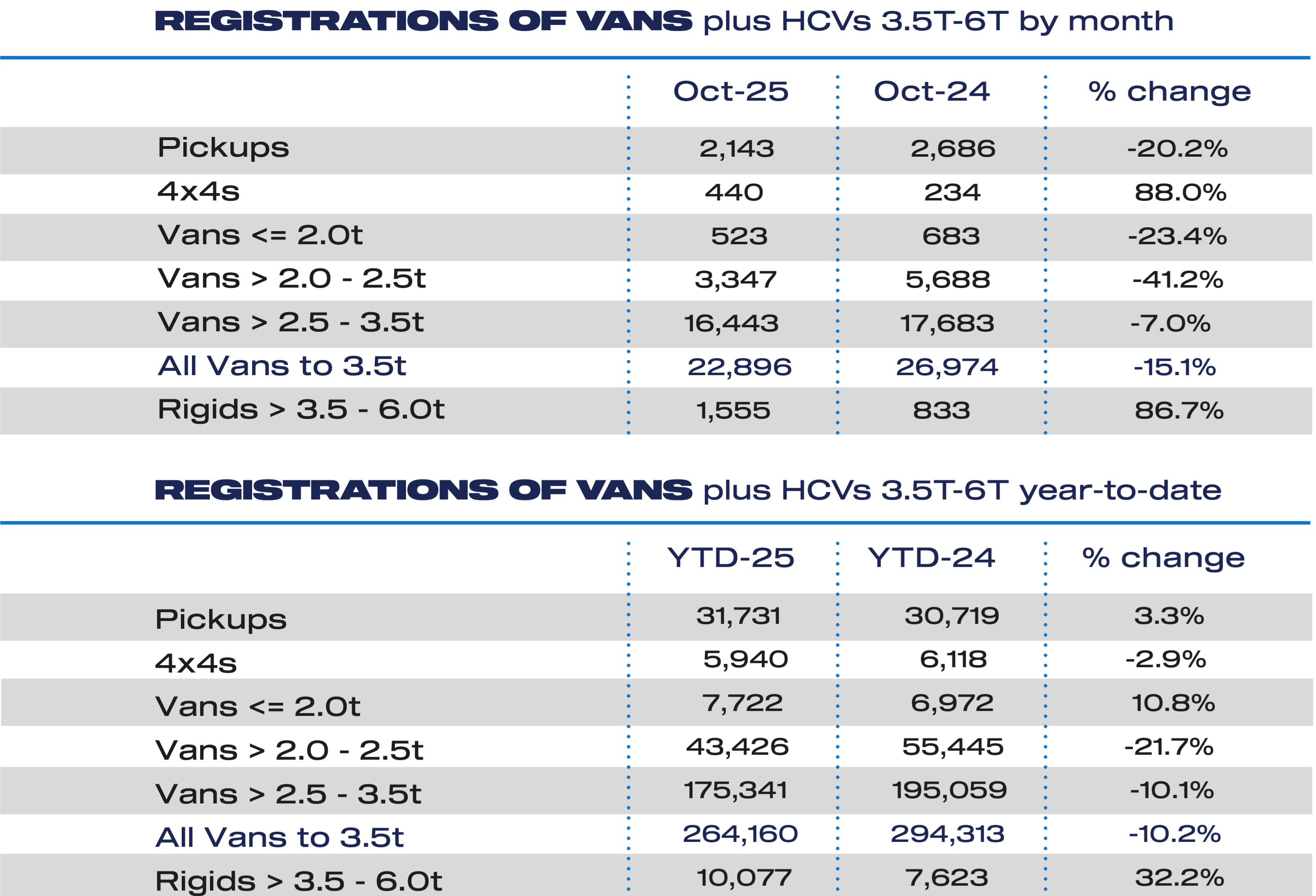

UK deliveries of new light commercial vehicles (LCVs) fell by -15.1% in October with 22,896 vans, pickups and 4x4s registered, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The decline follows a robust September market and reflects a contraction in fleet renewal across 2025, down -10.2% to 264,160 units in the year to date, amid weak business confidence and a tough economic environment.

Declines were recorded across all van sizes during the month, with volumes of the largest LCVs down -7.0% to 16,443 units but still representing the majority (71.8%) of the overall market. Registrations of new medium- and small-sized vans also fell, by -41.2% and -23.4% to 3,347 and 523 units respectively. There was growth in the smaller-volume 4×4 segment, with registrations up 88.0% to 440 units. Demand for new pickups, however, declined by -20.2% to 2,143 units, reflecting the impact of new fiscal measures to treat double cabs as cars for benefit in kind and capital allowance purposes.1

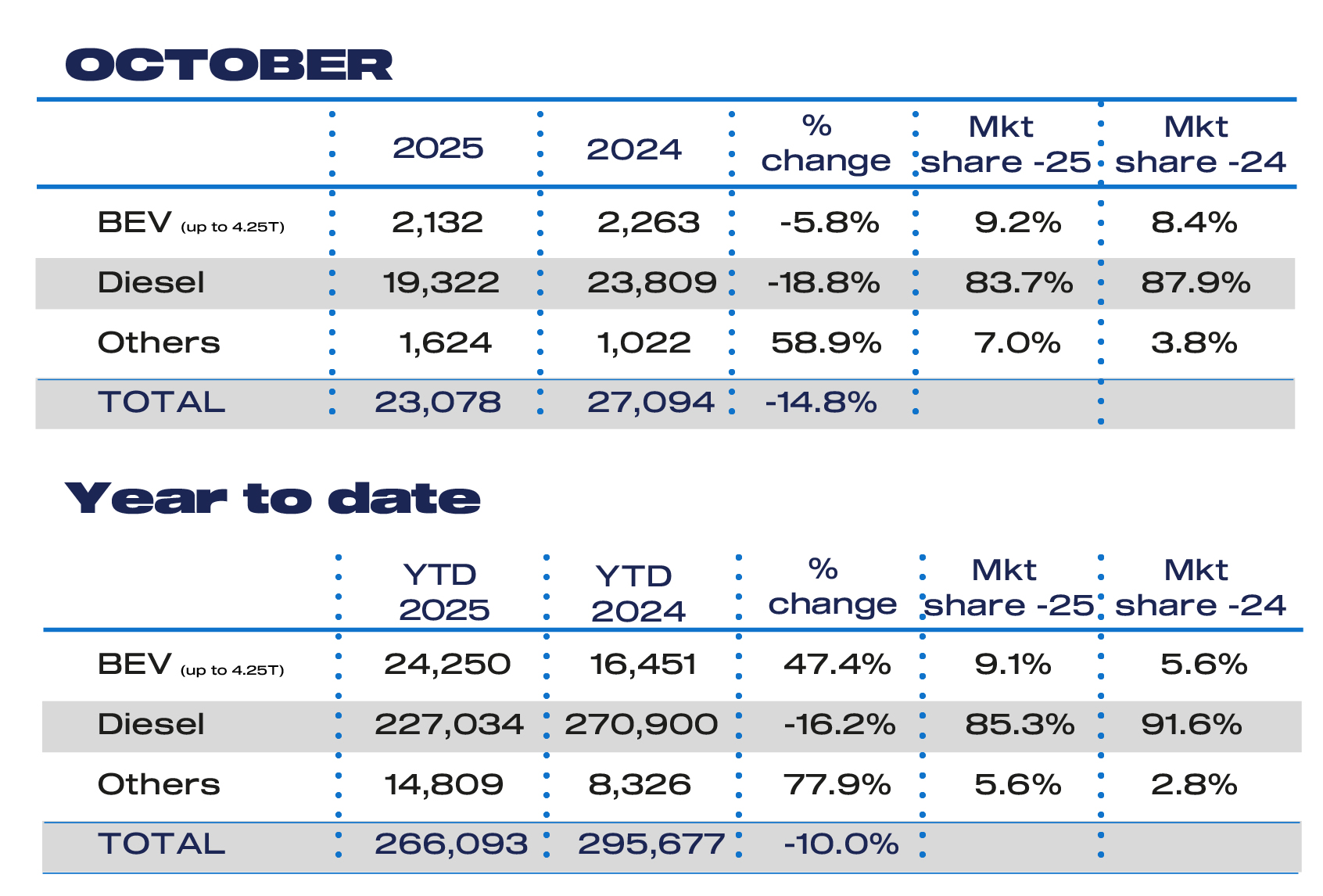

Volumes of new battery electric vans (BEVs)2 also declined for the first time 13 months,3 by -5.8% to 2,132 units, although the BEV market share edged up to 9.2%4, given the overall market’s steeper contraction. In the year to date, BEV volumes have increased by almost half (47.4%) to 24,250 units – significant growth bucking the trend of overall market decline thanks to manufacturers investing heavily in new model rollouts. Still, however, BEVs represent just 9.1% of all new registrations in 2025 – well below the 16% share mandated which rises to 24% in 2026.

Positive announcements this year – permitting new, non-zero emission and plug-in hybrid vans for sale up to 2035, the extension of the Plug-in Van Grant, the new Depot Charging Scheme, and last month’s proposal to reform planning rules for private charger installations – will all help the sector to decarbonise in line with market realities. Such changes must be implemented urgently to ensure mandated ambitions are deliverable.

Planning reform must also go further, specifically to support depot-based operators who require grid connections before switching fleets to electric. Given such operators often face grid connection wait times of up to 15 years, a fast-tracked approval process such as that afforded data centres and wind farms would help give business confidence to invest for a timely transition.5

Planning reform must also go further, specifically to support depot-based operators who require grid connections before switching fleets to electric. Given such operators often face grid connection wait times of up to 15 years, a fast-tracked approval process such as that afforded data centres and wind farms would help give business confidence to invest for a timely transition.5

Mike Hawes, SMMT Chief Executive, said, “While October’s decline is unsurprising amid the intense economic pressure facing businesses, returning the van market to growth is essential – especially to underpin new investment in zero emission models, which until now had bucked wider trends. Every lever must be pulled to get the market back on track, and transitioned at mandated levels. Accelerating infrastructure rollout and grid connections, in particular, will help ensure government targets are not just an aspiration but are actually deliverable for manufacturers and operators alike.”

The latest market outlook continues to expect the new LCV market to reach 321,000 units in 2025, a decline of -8.7% on last year. Uptake is anticipated to grow 4.2% to 334,600 units in 2026 and a further 0.6% in 2027. Uptake of zero emission LCVs weighing up to 3.5 tonnes is anticipated to grow by 47% this year to achieve a 9.7% market share, growing to 14% in 2026.

Matt Hawkins, Head of Flexis UK&I, said: “The latest SMMT figures for October show continued growth in the electric van market, with 47.9% year-on-year growth in new eLCV (< 3.5T) registrations a promising sign of a momentum shift towards zero-emission commercial vehicles. As e-commerce continues to grow, the air quality, cost-saving and operational efficiency benefits of electric vans are becoming increasingly valued by logistics fleets – particularly for those entering their busiest period of the year. With the right infrastructure, supportive policies and continued innovation, businesses are realising that the transition to electric vans is not only achievable, but a real business advantage. At Flexis, we remain committed to helping our customers make the switch to EVs a genuine competitive edge.”

1 HMRC, Car benefit: double cab pickups 6 April 2025 onwards.

2 SMMT’s BEV LCV registration data reflects the Vehicle Emissions Trading Scheme, in which BEVs weighing >3.5-4.25t contribute towards each manufacturer’s target, in addition to those weighing ≤3.5t.

3 New BEV LCV registrations, September 2024: 3,020 units.

4 New LCV BEV share, October 2025: 9.2%; October 2024: 8.3%.

5 DESNZ, Clean energy projects prioritised for grid connections, April 2025.