Teletrac Navman, a leading connected mobility platform, and ANGI Energy, a leading provider of hydrogen, CNG, and RNG fleet solutions, are both Vontier companies. The businesses provide digitally enabled equipment and solutions to support efficient operations and decarbonisation across the mobility ecosystem. Here David Muckle, Managing Director for Europe at ANGI Energy, talks about the latest developments in the UK hydrogen landscape.

When we talk about alternative fuels in the UK, most of the focus is on electrification. And for good reason – EVs have been the early frontrunners, with incentives, infrastructure, and manufacturer focus all pushing them into the mainstream. But for fleet operators, there’s a key contender that offers significant advantages for long-haul and high-utilisation operations: hydrogen.

The UK’s hydrogen ecosystem is currently slightly behind the curve but that’s understandable when you consider the entire value chain is in its infancy and needs to mature concurrently and at pace.

At present, infrastructure is sparse, with just a handful of public filling stations operational today, and production also not plentiful. When you compare that with the nationwide spread of EV charge points, the perception is that hydrogen it isn’t making progress as a viable alternative energy.

But the wheels are well and truly in motion for that to change. The groundwork is being laid significantly and once in place, hydrogen could become a cornerstone for fleets that demand longer range, faster refuelling, the ability to haul their maximum payloads, and operational resilience.

Major projects are already in motion. The M4 corridor, for example, is one of several motorway-based hydrogen fuelling infrastructure plans that have received approval or broken ground. Other projects seeing investment include the Aberdeen Hydrogen Hub, Bradford Hydrogen Project, and TEES Green Hydrogen project. The network is growing and there’s clear momentum.

On the production side, yes supply needs to improve and the cost per kilogram is still high, but these aren’t going to be long-term constraints. More electrolysis plants that produce green hydrogen via renewable energy sources are coming online, just like the Kintore project in Scotland which will potentially be the largest in Europe. As more facilities open, we’ll see increased supply driving down the price, as well as the processes become more efficient and cost-effective over time.

When it comes to the types of hydrogen available, Green hydrogen (from renewable sources) is the gold standard, but blue hydrogen – produced from natural gas with carbon capture – will likely play a transitional role. This dual approach can help scale the market quickly while maintaining sustainability goals. The key is to strike a balance between immediate scalability and long-term carbon neutrality.

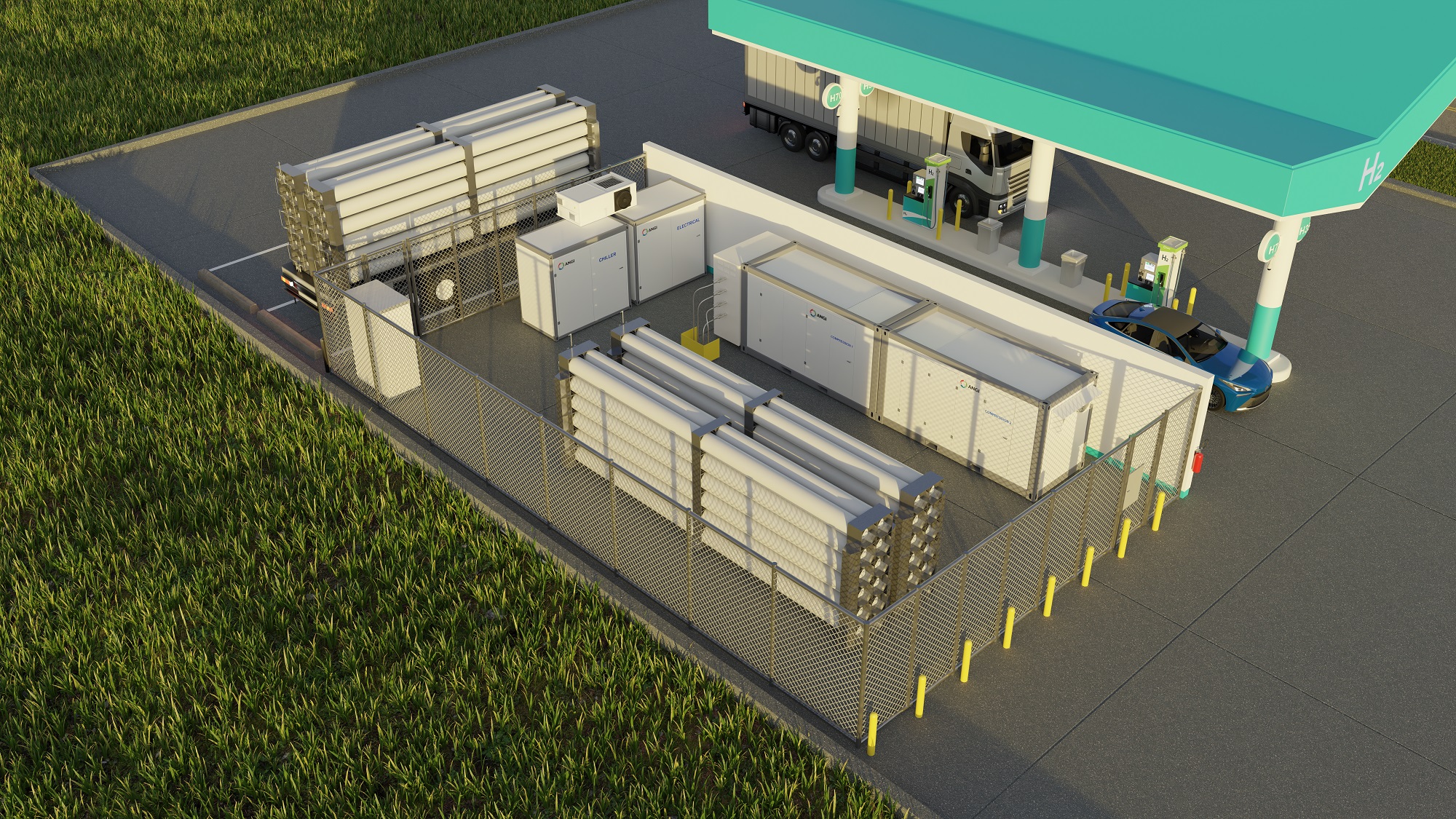

There are some considerations for operators looking to run a hydrogen-based fleet: do you invest in on-site hydrogen infrastructure or rely on a growing public network of fuelling stations? Installing hydrogen systems is not cheap – it involves high-pressure storage (typically 500 bar to deliver an operating pressure of 350 bar into vehicles), specialist safety systems, and significant space. Storing hydrogen safely and at the correct pressure is critical to ensure vehicles can operate properly. Conversely, it doesn’t require the same level of electrical infrastructure and cabling that a heavy duty EV fleet would, which is also a costly up-front expenditure. So, if your fleet is large enough or your duty cycles demand high uptime, the case for on-site investment becomes more compelling.

Take HGVs and public buses – these are precisely the vehicles hydrogen is best suited for. Scania has just launched a new hydrogen-powered truck offering up to 850 km on a single tank. Compare that to the range limitations and lengthy charging times of electric HGVs, and hydrogen starts to look far more operationally viable. Refuelling time is another big plus: hydrogen vehicles take only slightly longer to fill than diesel ones, making them ideal for tight schedules and continuous operations. Many councils across the country have rolled out public buses that are EVs, but the long charging times can impact service levels. That’s where hydrogen offers a strong alternative. Companies like Wrightbus and Jo Bamford, are already producing hydrogen buses that are in service today. The technology exists – it’s just a matter of scaling.

Unfortunately, hydrogen suffers from a few lingering misconceptions. One of the most common is that it’s too carbon-intensive to be worth the investment. But this argument increasingly fails to hold up when you consider the majority of UK hydrogen producers use renewable power for electrolysis, and blue hydrogen will be phased in strategically to boost supply. Ironically, the EV world doesn’t get nearly as much scrutiny over electricity sourcing – even though much of the UK’s grid electricity still comes from gas or imports. If we’re going to have a fair comparison, we need to be just as critical of the energy behind the plug as we are of the fuel in the tank.

Hydrogen is already gaining traction among forward-thinking operators. It’s a viable option today for certain use cases, and as the infrastructure, production capacity, and the support of OEMs grows, its role will expand further. For the value chain to establish effectively it will need a united front from all involved.

For any fleet considering hydrogen, the decision needs to be pragmatic and data-driven. Understand your vehicle duty cycles, payload requirements, route distances, and refuelling needs. Hydrogen won’t be the answer for every vehicle, but for long-haul routes or high-utilisation public transport, it could be the most viable solution available.