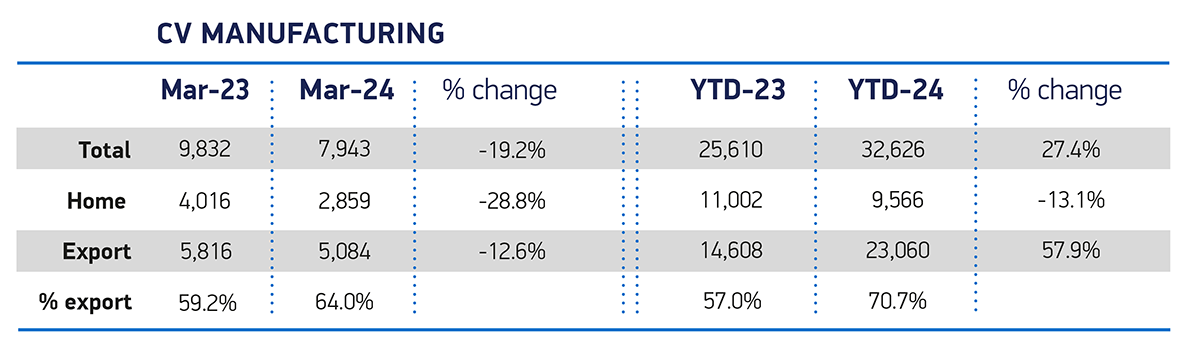

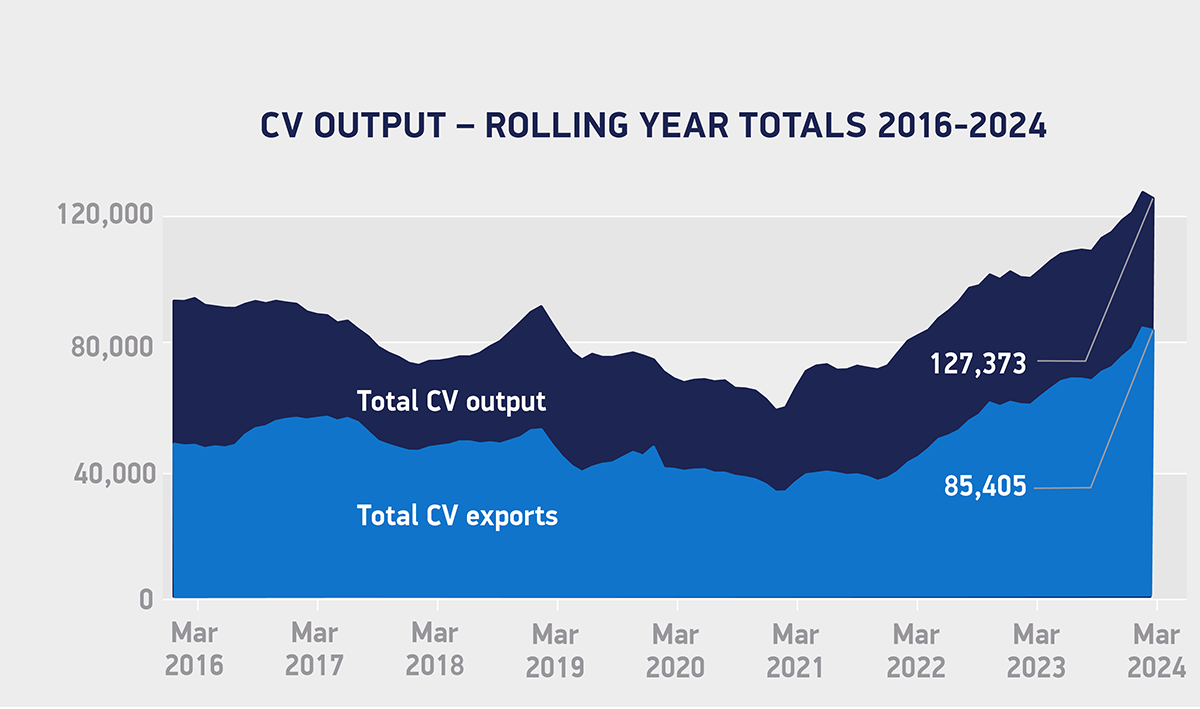

UK commercial vehicle (CV) output rose by 27.4% in the first quarter of 2024, the best Q1 performance since 2008, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT).1 32,626 vans, trucks, taxis, buses and coaches left factory lines, up 18.6% on pre-pandemic 2019 volumes, with demand driven by overseas orders.2

Exports rose 57.9% to 23,060 units in the first quarter – an increase of 8,452 vehicles to account for 70.7% of year to date output, up from 57.0% in Q1 2023 – thanks to demand for the latest cutting edge and increasingly zero emission British-built CVs. The EU remained the top export destination, with more than nine in 10 vehicles (96.7%) heading for the bloc. Production for the UK market, meanwhile, declined -13.1% to 9,566 units.

Exports rose 57.9% to 23,060 units in the first quarter – an increase of 8,452 vehicles to account for 70.7% of year to date output, up from 57.0% in Q1 2023 – thanks to demand for the latest cutting edge and increasingly zero emission British-built CVs. The EU remained the top export destination, with more than nine in 10 vehicles (96.7%) heading for the bloc. Production for the UK market, meanwhile, declined -13.1% to 9,566 units.

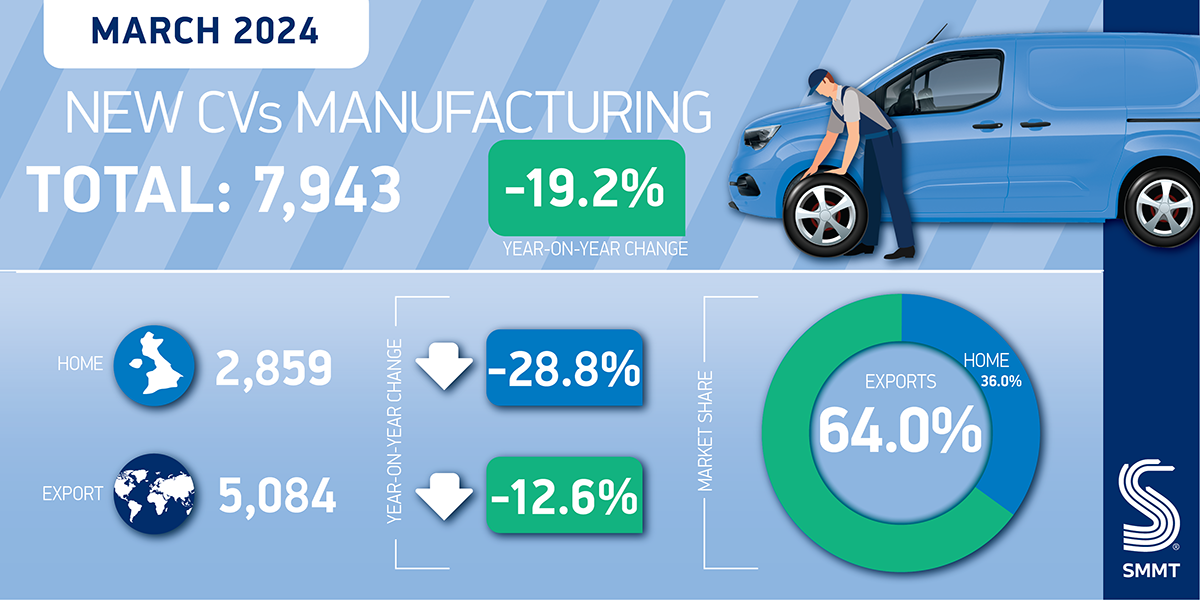

Growth in January and February, however, was followed by a -19.2% decline in March output to 7,943 units – the first monthly fall since September 2023. Exports declined by -12.6% to 5,084 units against the same month last year, with 732 fewer units made, while production for the UK fell -28.8% to 2,859 units. The performance reflects market normalisation as manufacturers have worked hard to meet strong pent up pandemic-related demand, as well as some temporary supply chain shortages and the early Easter bank holiday reducing working days in the month compared with 2023. Growth is still expected this year, with the latest independent outlook expecting light van production volumes to hit over 135,000 units – a result of electric vehicle output ramping up.3

Mike Hawes, SMMT Chief Executive, said, “It’s good to see UK CV production record its best Q1 performance in some 16 years, success testament to the determination of manufacturers to deliver for this vital sector, while investing in the latest cutting edge, ultra low and zero emission technology. Global demand continues for British-built commercial vehicles, emphasising the need for favourable market conditions to sustain our production capabilities for increasingly green vehicles. This means reducing energy costs, upskilling our workforce and maintaining free and fair trade deals, the result of which will allow us to attract further investment to improve productivity and decarbonise automotive manufacturing and its supply chain.”

“It is promising to see the new van market continue its momentum into Q2 witnessing an increase of 5.4%, the best April for three years, and marking a sixteenth month of consecutive growth” said Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK commenting on the latest SMMT’s new passenger van registration figures.

Sue Robinson added: “The 2.5-3.5t sector represents the dominant vehicle choice accounting for the majority of LCV registrations. These LCVs are operated by both large fleets and local tradesmen and have a very wide appeal due to their maximum payload capacity.

“It is notable that the take-up of EV commercials remains weak with market share for April falling well below that recorded in April 2023. Similarly, year-to-date figures see a similar story with EV market share at 4.9%, -0.5% lower than the market share recorded at this same point last year.

“Van buyers need confidence from the Government to make the switch to new EV commercials through measures such as improving charging infrastructure. With the ZEV mandate stipulating that 10% of vans sold by manufacturers this year are required to be zero-emissions or face penalties, it is crucial that incentives are introduced by the Government to drive up demand and meet these targets.”

- Jan-March performance, 2008: 60,294 units

- Jan-March performance 2019: 27,513 units

- Based on AutoAnalysis independent outlook, March 2024