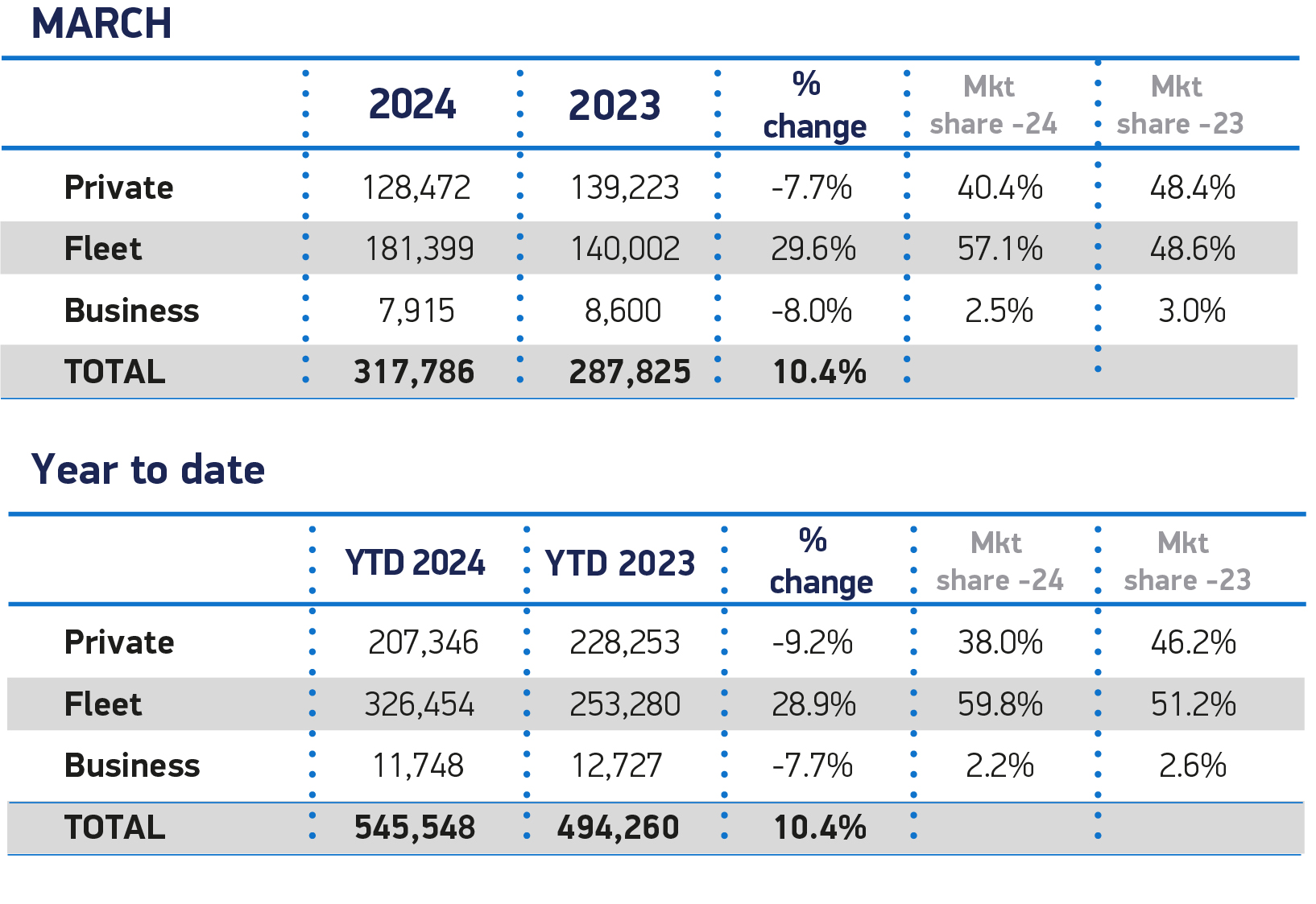

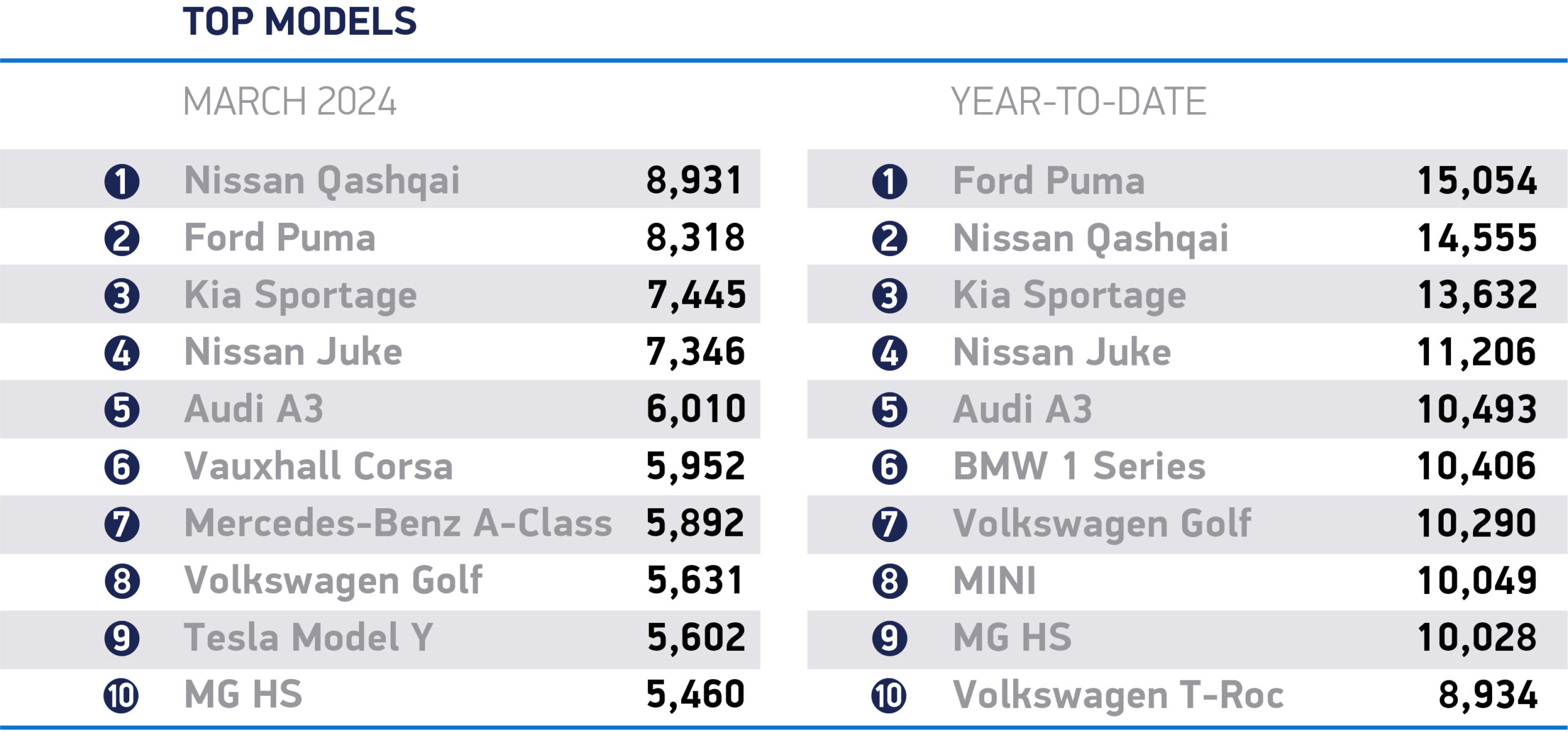

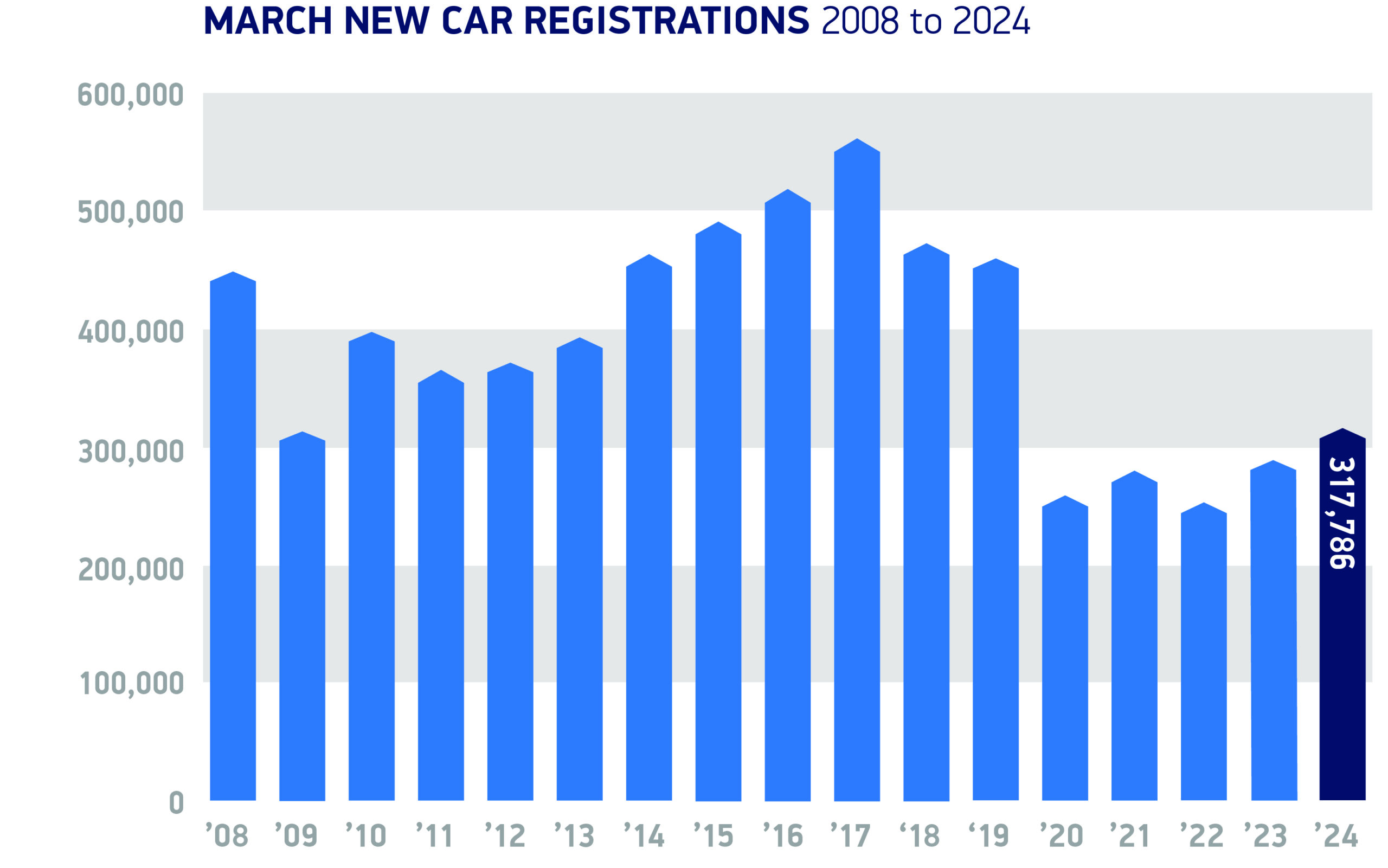

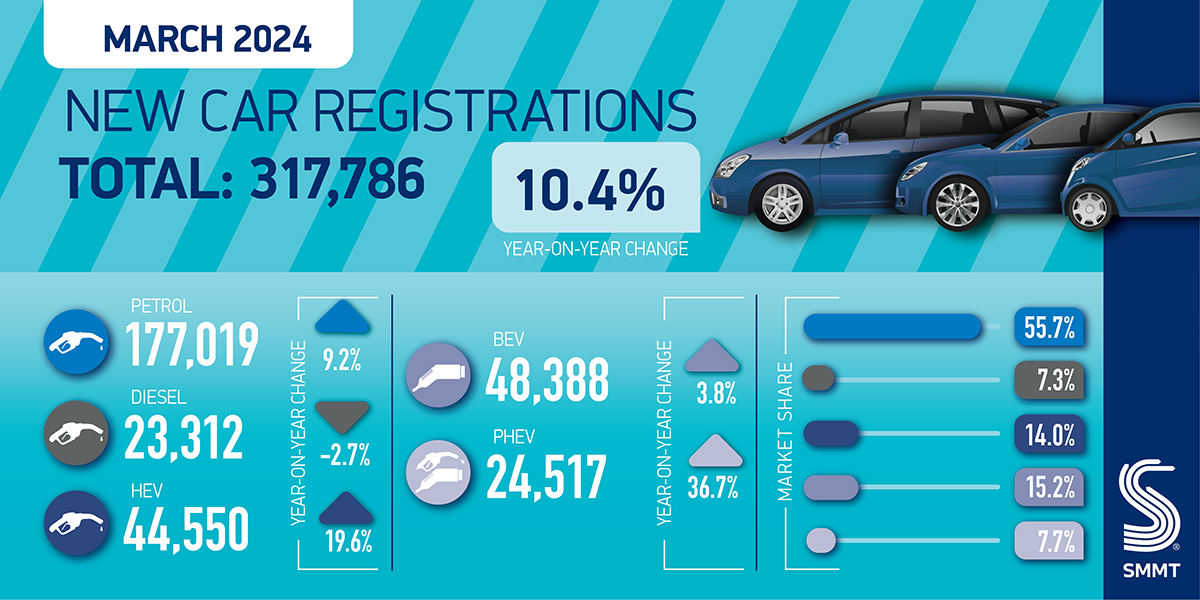

The UK new car market clocked up its 20th consecutive month of growth in March, with a 10.4% rise in registrations. In what is typically the busiest month of the year due to the new numberplate, 317,786 new cars reached the road with a 24 plate – the best March performance since 2019, although still -30.6% below pre-pandemic levels.1

Growth was again driven by fleet investment, up 29.6% as the sector continues to recover following the constrained supply of previous years. Registrations by private buyers fell by -7.7%, with a challenging economic backdrop of low growth, weak consumer confidence and high interest rates. The small business registration segment, meanwhile, declined -8.0%.

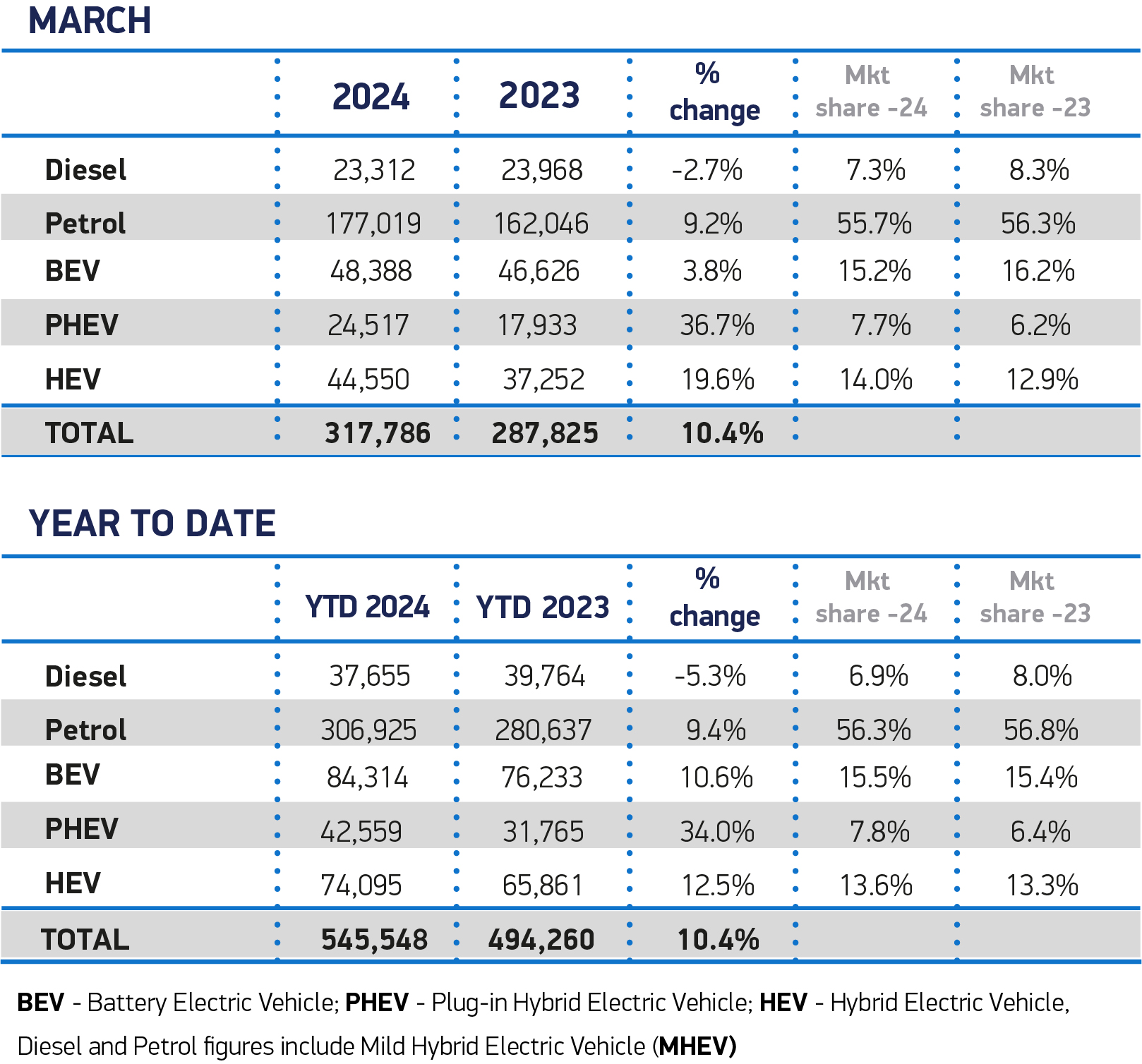

Petrol cars retained the lion’s share of the market, at 55.7%, with registrations up 9.2% year on year, as diesel volumes fell -2.7% to account for just 7.3% of demand. Uptake of hybrid electric vehicles (HEVs) reached record levels, rising by 19.6% to 44,550 units and 14.0% of the market, while the biggest percentage growth was recorded by plug-in hybrids, up by more than a third to 24,517 units, or 7.7% of all new registrations. Conversely, while battery electric vehicle (BEV) registration volumes were at their highest ever recorded levels, market share fell by one percentage point from the same month last year, down to 15.2%. Registrations rose 3.8%, with only fleets showing any volume growth.

Petrol cars retained the lion’s share of the market, at 55.7%, with registrations up 9.2% year on year, as diesel volumes fell -2.7% to account for just 7.3% of demand. Uptake of hybrid electric vehicles (HEVs) reached record levels, rising by 19.6% to 44,550 units and 14.0% of the market, while the biggest percentage growth was recorded by plug-in hybrids, up by more than a third to 24,517 units, or 7.7% of all new registrations. Conversely, while battery electric vehicle (BEV) registration volumes were at their highest ever recorded levels, market share fell by one percentage point from the same month last year, down to 15.2%. Registrations rose 3.8%, with only fleets showing any volume growth.

The fall in BEV market share within a growing market underscores the need for government to support consumers to speed up fleet renewal. Large fleets continue to drive BEV uptake, thanks to compelling tax incentives but while registration volumes increased in March, market share declined. A tough economic backdrop makes it ever more challenging for consumers to invest in these new technologies.

Manufacturers themselves are offering generous incentives, helping more drivers switch to zero emission vehicles and deliver government and industry carbon targets, but this cannot be sustained indefinitely.2 A full market transition needs incentives not just for fleet and business buyers but private retail buyers as well, something that would bring the UK into line with other major markets. Temporarily halving VAT on BEVs, revising the threshold for the expensive car supplement on Vehicle Excise Duty next April, and abolishing the ‘pavement penalty’ on public EV charging by equalising VAT rates to 5% in line with home charging, would make a significant difference to consumers, helping more of them move to zero emission vehicles sooner.

Mike Hawes, SMMT Chief Executive, said, “Market growth continues, fuelled by fleets investing after two tough years of constrained supply. A sluggish private market and shrinking EV market share, however, show the challenge ahead. Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely. Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.”

Jon Lawes, Managing Director at Novuna Vehicle Solutions, one of the UK’s largest fleet operators, said: “The new plate month inevitably sparks strong take-up of zero-emissions vehicles, yet the transition is in danger of stalling without addressing the fundamental barriers to EV adoption, particularly after a lacklustre Spring Budget.

“Achieving the ZEV Mandate will prove increasingly difficult unless support measures for private buyers to make the switch are introduced, coupled with the sustained rollout of EV charging infrastructure which remains unfit for purpose.”

David Borland, EY UK & Ireland Automotive Leader, comments on the Society of Motor Manufacturers and Traders (SMMT) new car registration figures for March 2024:

“The new plate month of March 2024 delivered 317,786 new car registrations, marking the 20th consecutive month of growth for the UK auto industry as well as representing a 10.4% year-on-year increase and the best March since 2019.

“These results underscore the continued resilience of the sector despite a variety of persistent headwinds. This includes ongoing consumer confidence challenges, due in part to interest rates staying high for longer than many anticipated, and a complex and evolving regulatory environment in relation to decarbonisation as well as finance and insurance products.

“In response, Original Equipment Manufacturers (OEMs) have ramped up sales incentives and discounts offered to consumers to boost demand, and we are seeing clear signs of a return towards the ‘supply push’ model. However, how sustainable such incentives will be longer term remains to be seen.

“Battery Electric Vehicle (BEV) sales were up by 3.8% year-on-year in March, while the appeal of Plug-in Hybrid Electric Vehicles (PHEVs) as a transition technology continued to be evident, with sales up 36.7% compared to March 2023. Despite this growth, the percentage of BEVs sold so far this year in terms of market share declined to 15.2% last month, down from 15.8% in February, meaning BEV market share remains substantially below the 22% target of the ZEV mandate. This is likely to be due, in part, to ongoing consumer hesitancy caused by the delay to the Internal Combustion Engine (ICE) sales ban, persistent concerns about charging infrastructure adequacy and more recent issues around BEV residual values and insurance premiums.

“As with previous months, fleet remains the key driver of registration volume growth, with a 29.6% increase year-on-year. However, March’s outlook for private sales was much more subdued, with a year-on-year decline of 7.7%. Indeed, the absence of EV-related subsidies for private retail consumers, as well as ongoing high retail prices and reduced affordability of finance given higher APRs, continues to drag on this segment of the market.”

Chris Leslie, Commercial Director at MAF Finance Group, said: “The latest figures from the Society of Motor Manufacturers and Traders (SMMT) provide a strong indication that the British car industry is maintaining its momentum, with new car sales in March revving up by an encouraging 10% compared to last year.

“March typically signals the peak of activity in the car market, as consumers take advantage of the new registration plate. The rise in sales also follows February’s two-decade high, underscoring the strength of the recent recovery after years of difficulties.

“That said, the road ahead isn’t completely clear. Private demand was subdued in March which suggests would-be buyers are still grappling with the cost-of-living crisis and finding it hard to justify spending on new vehicles.

“On top of this, there’s been a 1% slip in electric vehicle market share from last year, with fleet purchases the only bright spot. After a recent downturn in sales reported by both BYD and Tesla, this is a worrying but unsurprising development, with patchy charging infrastructure and high costs still deterring buyers.

“The situation shines a light on the need for government to help the market along. The infrastructure must improve and we need more charging points. On top of that, consumers need incentives to help make the costs more palatable. Manufacturers have cut prices, but targeted government measures, like a VAT cut on new electric cars and a Vehicle Excise Duty overhaul, could nudge consumers towards greener choices.

“Despite these headwinds, the industry can take some comfort in the overall positive direction of travel. The increase in new car sales demonstrates the resilience and adaptability of the sector, and with the right policies in place, we can hope to see private sector sales pick up speed in the near future.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said: “New car registrations grew by 10.4% last month in the best March since 2019. This is particularly significant given this month remains the most important in the automotive industry calendar, with around a fifth of all new sales recorded following the launch of latest number plate. The introduction of the new ‘24’ registration plate saw over 300,000 new cars reach the roads.

“March also saw a slight uptick in battery electric vehicles (BEV) registrations at 3.8%, driven by fleet renewals, and now represent over 15% of the overall market. However, this remains below the government’s zero-emission vehicles (ZEV) target of 22%, driven by ongoing consumer concerns around price and access to charging infrastructure.

“Deloitte’s recent Global Automotive Consumer study shows that affordability concerns are also among the top reasons to change vehicle as consumers continue to feel cost pressures. Initial sticker price, combined with continued uncertainties over residual prices and high interest rates, are resulting in higher monthly payments that are causing customers to hesitate about switching to a BEV. Additionally, concerns about being able to regularly access available public charging infrastructure continues to act as a drag to adoption, particularly for those customers without off-street parking. Plug-in hybrid electric vehicles (PHEV) are increasingly a more popular alternative for consumers in the meantime, with PHEV registrations growing 36.7% in March.”

1 March 2019: 458,054 registrations

2 What Car research shows EV discounts have increased by 204% since January 2023