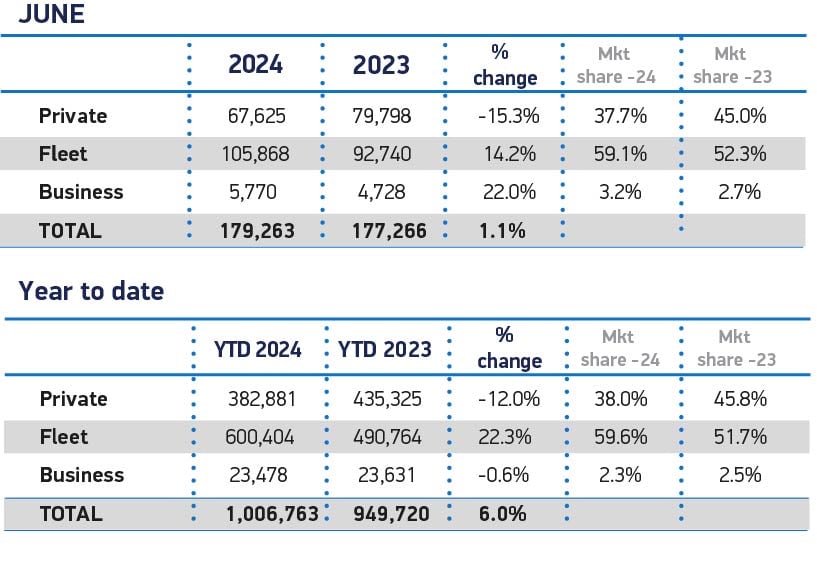

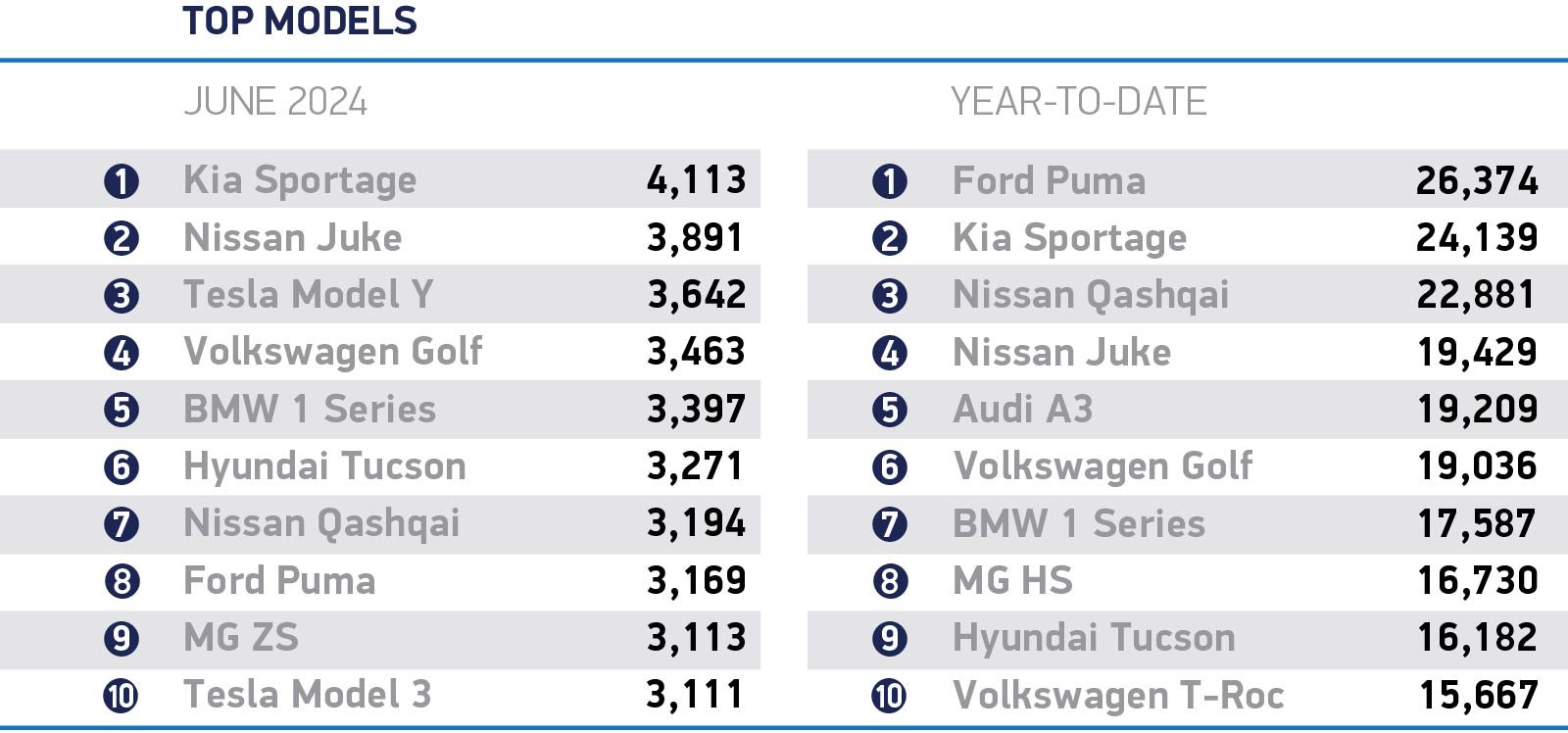

The UK new car market has hit the half year million motors mark for the first time in five years, after new car registrations rose in June by a modest 1.1% to reach 179,263 units, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT). As a result, so far in 2024, 1,006,763 new cars have been registered, up 6.0% on the previous year but still down -20.7% on 2019.1

June’s market growth was driven primarily by the fleet sector, where uptake rose by 14.2%, while private retail demand fell for the ninth consecutive month, down -15.3%. Retail buyers accounted for fewer than four in 10 new cars registered (37.7%).

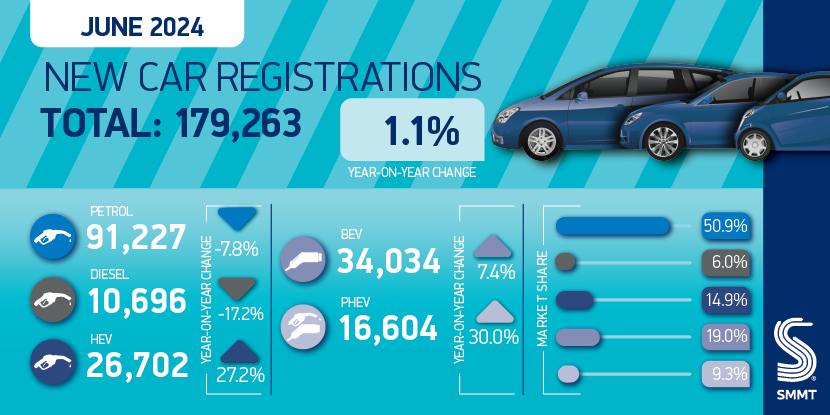

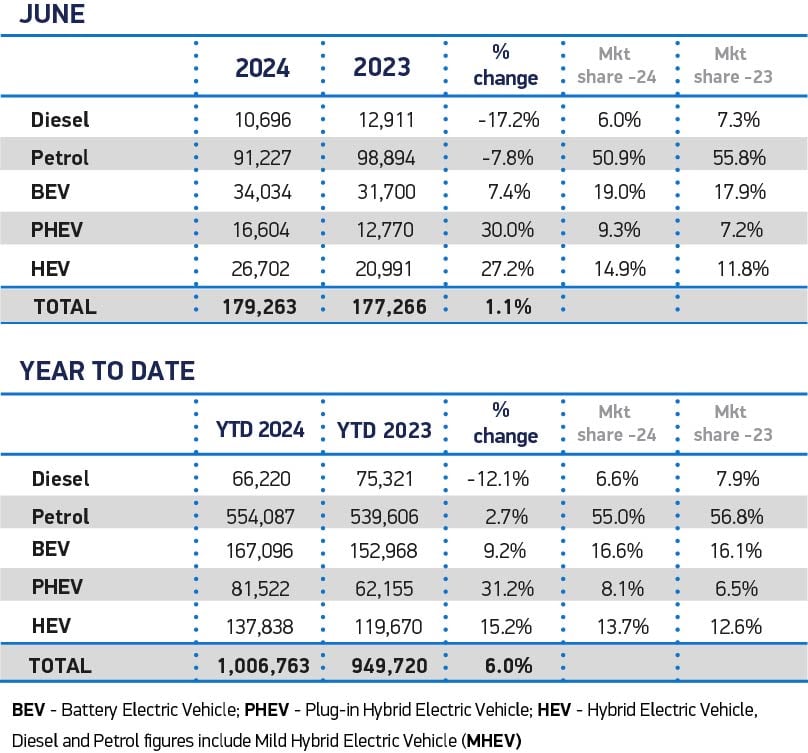

Electrified vehicle uptake continued to grow robustly in June, with plug-in hybrid (PHEV) volumes up 30.0% to reach a 9.3% market share, while hybrid electric vehicles (HEV) rose 27.2% to achieve 14.9% of the market. Both powertrains also outpaced battery electric vehicle growth (BEV), which rose 7.4% but took its highest monthly share this year, accounting for 19.0% of all new vehicle registrations.

The UK’s zero emission transition – and the ability of manufacturers to meet the requirements of the Vehicle Emissions Trading Scheme – currently relies on the fleet sector as private consumer uptake continues to soften. Private BEV uptake has fallen -10.8% year to date, with fewer than one in five new BEVs going to private buyers. Overall, BEVs now comprise 16.6% of the new car market so far this year, slightly above the 16.1% achieved in the same period last year, with uptake behind the levels mandated by government.

With the UK heading to the polls today, the automotive industry calls on the next government to provide greater support to the consumer on the journey to zero emission mobility. Re-instating fiscal incentives for the private consumer by way of a halving of VAT on BEVs for three years would re-energise the market, putting an additional 300,000 private BEVs – rather than petrol or diesel cars – on the road over the next three year, on top of current outlooks.2 This would help ensure that in 2035, half of all cars in use would be zero emission, cutting road transport CO2 emissions by 175 million tonnes between now and then.

Vehicle Excise Duty plans should also be revised so zero emission vehicles (ZEVs) are classed as essential rather than “luxury” vehicles, by amending the ‘expensive car’ supplement due to be applied from next April. In addition, public charge point use could be made fairer by reducing VAT from 20% to 5%, in line with home charging – a move that would support ZEV uptake and send the right message to consumers.

Mike Hawes, SMMT Chief Executive, said: “The year’s midpoint sees the new car market in its best state since 2021 – but this belies the bigger challenge ahead. The private consumer market continues to shrink against a difficult economic backdrop, but with the right policies in place, the next government can re-energise the market and deliver a faster, fairer zero emission transition. All parties are agreed on the need to cut carbon and replacing older fossil fuel based technologies with new electrified powertrains is the essential step to achieving that goal.”

Jon Lawes, Managing Director at Novuna Vehicle Solutions, one of the UK’s largest fleet operators, said: “Businesses need stability and confidence if they are to plan for long-term investment. With the UK heading to the polls, it’s vital the election ends this period of uncertainty on transition goals and provides cast iron EV adoption deadlines.

“There is a long road ahead. Consumers considering the EV switch are contending with affordability hurdles and a dearth of charging infrastructure. Whoever forms the next government urgently needs to adopt a bold strategy to mobilise policy incentives and deploy infrastructure investment.”

Russell Olive, UK Director, vaylens comments: “New car sales continue accelerating. And growth is largely driven by fleets and businesses who are shifting towards electric vehicle models (EVs) at speed.

“However, to ignite demand among private consumers and meet the targets mandated under the Vehicle Emissions Trading Scheme, there’s likely going to be more calls for the next government to offer more incentives that encourage drivers to make the switch to EVs too.

“It’s also important to remember the tasks involved in managing more EVs on the road, will be totally different to those involved in managing the fuel supply for petrol or diesel vehicles. For example, businesses will need to use EV charging management software to monitor the status of charging points, track energy use, ensure uptime and smoothly manage payments and reimbursements.

“Today’s figures hint that a lot more work still needs to be done in the underlying infrastructure to address pinch points around how the EV market will function effectively long-term, and shift demand up a gear from drivers on the road.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte said: “New car registrations continue to grow but still dominated by fleet sales. Efforts to incentivise private consumers to make the switch to electric needs ramping up, especially as the market share for electric vehicles is still below the required 22% as set out in the zero-emission vehicle mandate.

“Whilst the rollout of superfast charging infrastructure is happening, there is a need for more accessible public charging. A Deloitte survey shows that consumers are more than twice as likely to be interested in switching to an electric vehicle if their home has access to off-street parking and charging facilities. The majority of people considering an electric vehicle want to charge their cars close to home, which makes charging a major barrier to purchase for consumers without access to off-street parking.

“Plug-in hybrid electric vehicles are also becoming a more popular alternative for consumers with registrations up by 31% in the six months to June compared to the same period a year ago. This resurgence however has had an impact on suppliers who now need to support manufacturers with parts for both petrol and diesel cars, hybrids and electric vehicles, all simultaneously. As suppliers continue to navigate considerable budget pressures, this will likely result in further mergers and acquisitions and strategic partnerships between manufacturers and suppliers, so they can share the investment burden.”

1 Jan-Jun 2019 new car registrations: 1,269,245

2 SMMT: Back Automotive and reap £50bn growth