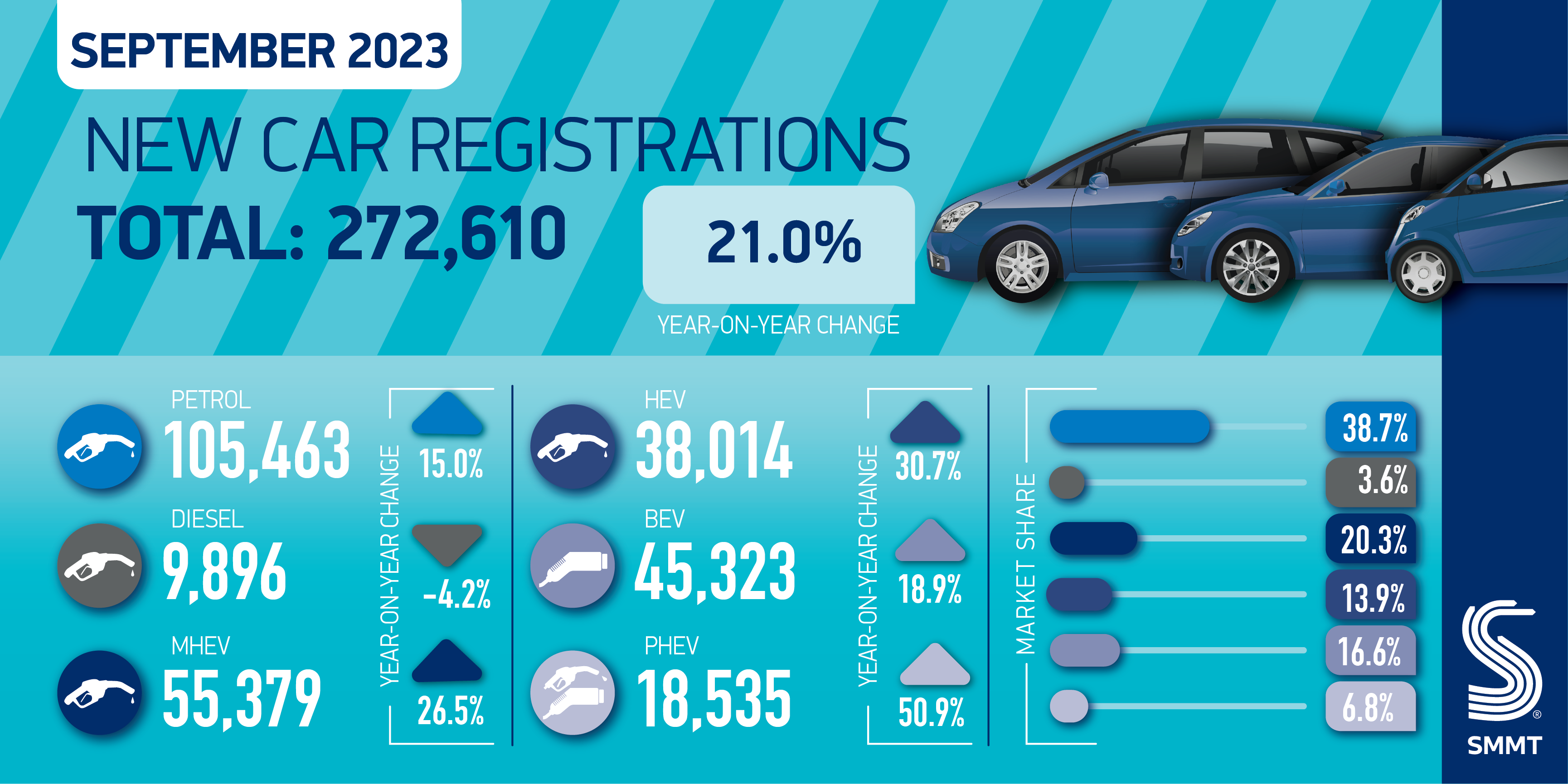

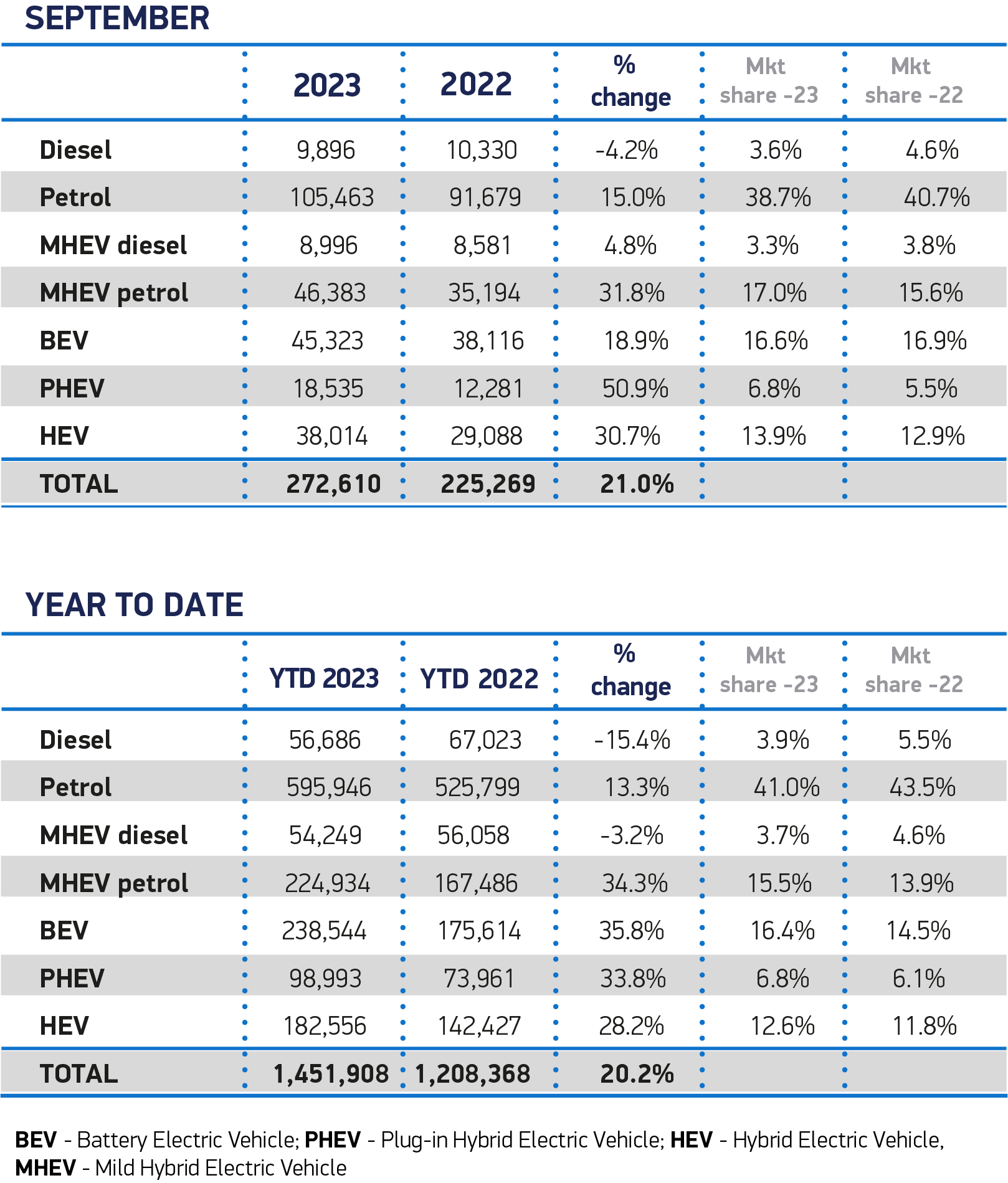

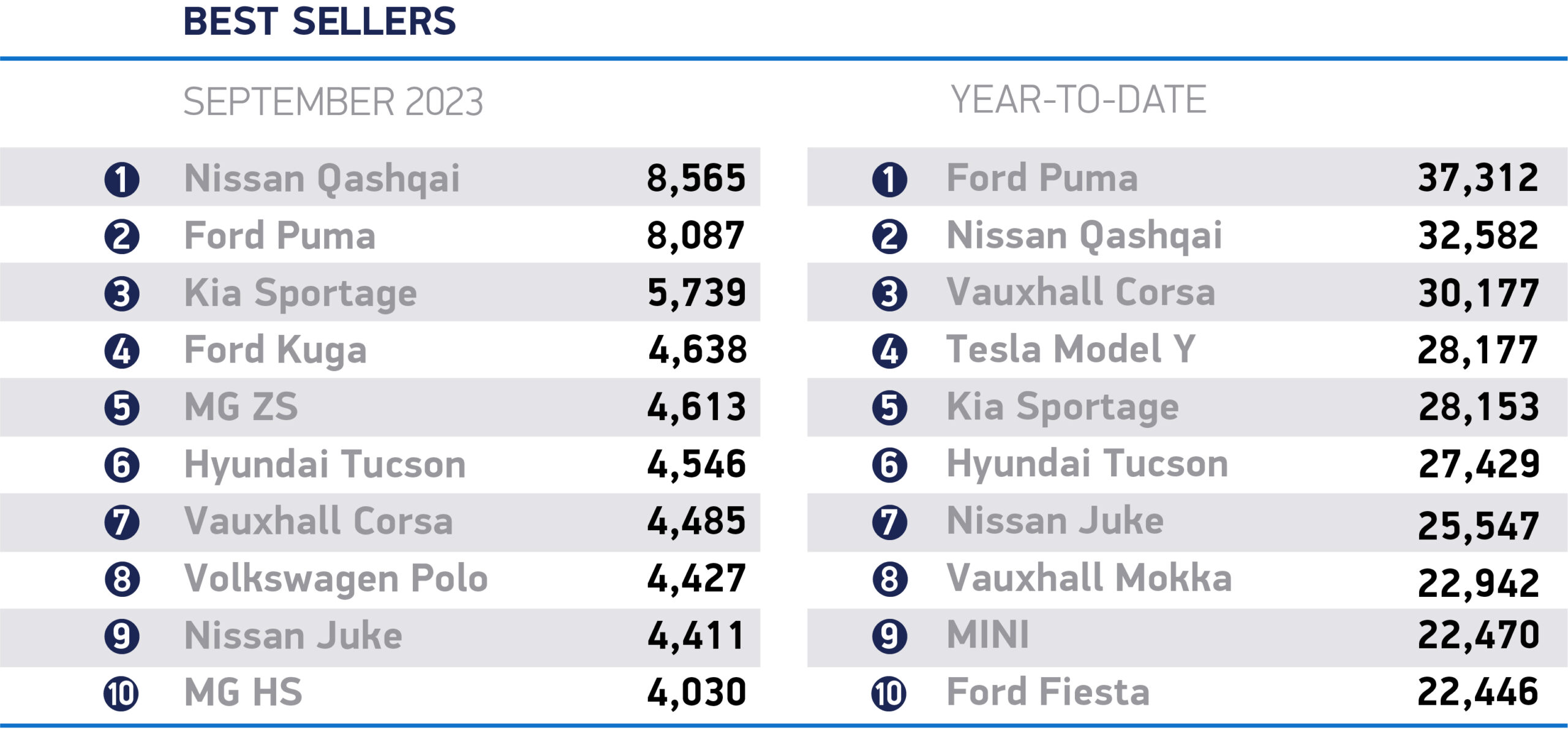

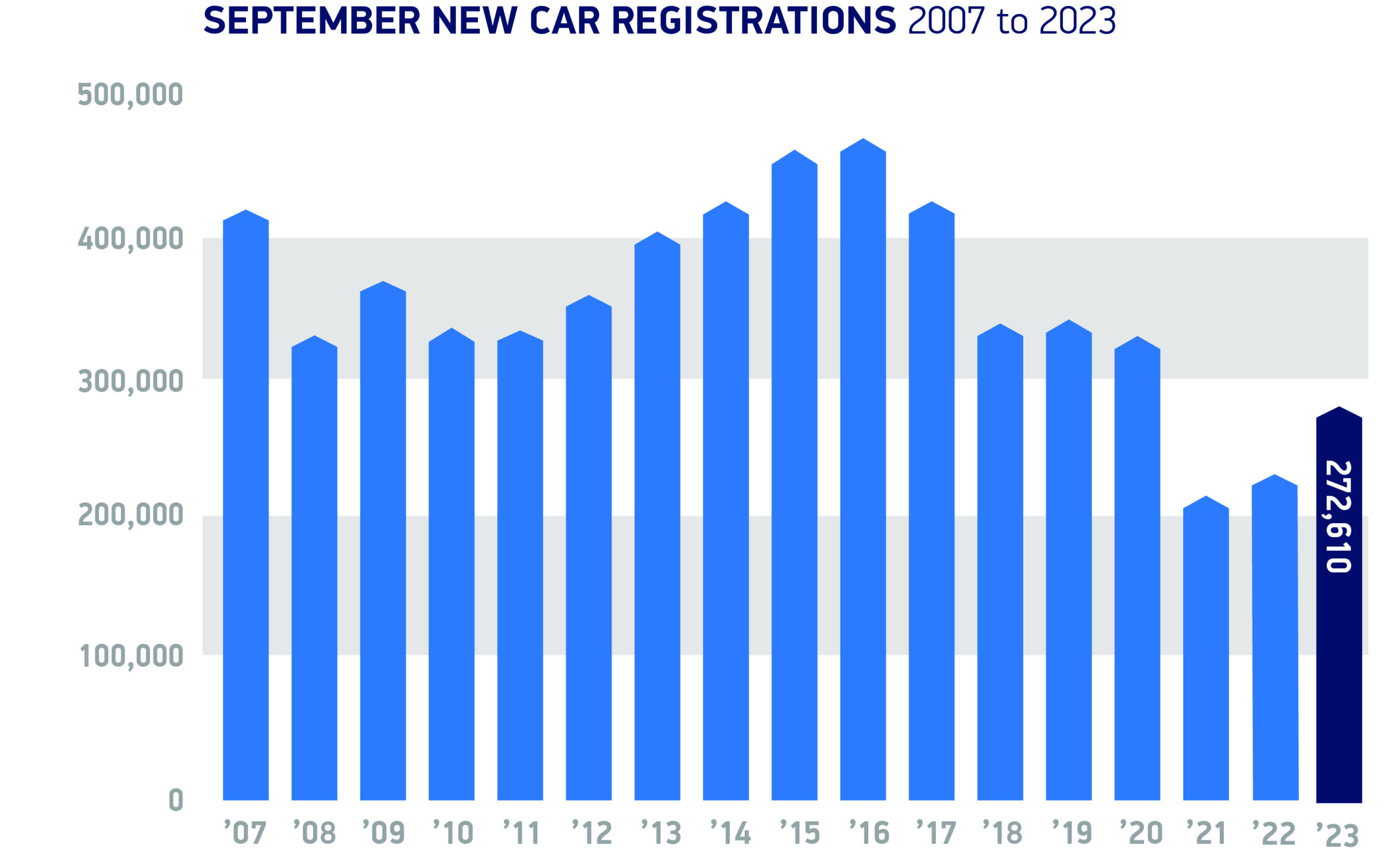

The UK new car market grew 21.0% in September with 272,610 registrations in the month, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The 14th consecutive month of growth was also the second busiest of the year after March, with the new number plate delivering its traditional market surge despite a challenging economic backdrop.

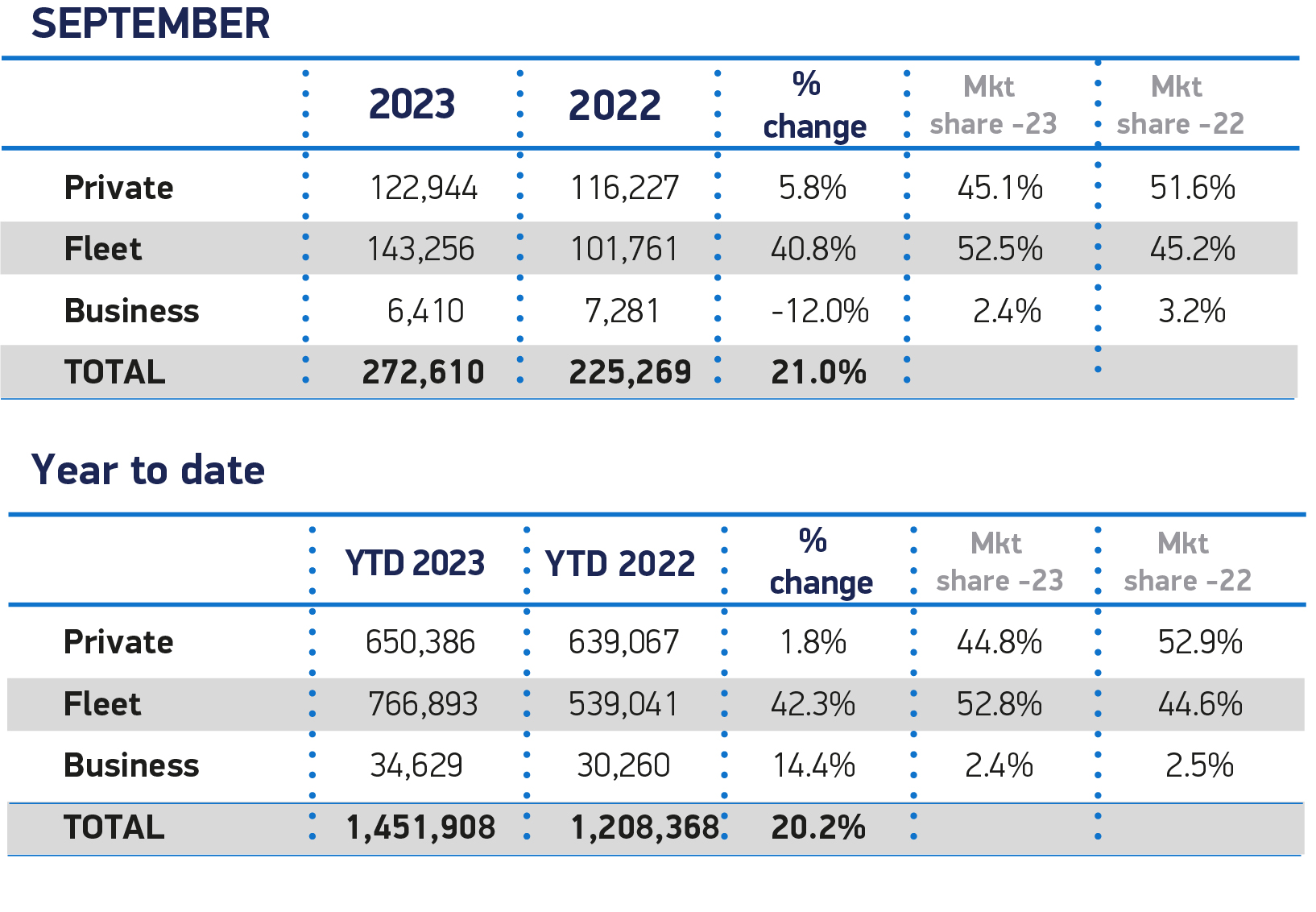

Growth continued to be driven by large fleets, which rose 40.8% to 143,256 units to reach a market share of 52.5%. This represents a market rebalancing after constrained supply in 2022 restricted deliveries to business and fleet customers. Private consumer demand, meanwhile, also grew, up 5.8% to 122,944 units. As a result, the industry enjoyed its best September since 2020,1 although registrations remain -20.6% below pre-pandemic levels.2

Electrified vehicle uptake continued to grow in the month, with plug-in hybrid vehicles (PHEVs) up 50.9% to take a 6.8% market share and hybrid electric vehicles (HEVs) up 30.7% to account for 13.9% of all registrations. Battery electric vehicles (BEVs), meanwhile, recorded their 41st consecutive month of growth – with 45,323 drivers making the switch, an 18.9% uplift. Given this growth was less than the overall recorded by the market, however, BEV market share slipped back slightly to 16.6% from 16.9% a year ago.

BEV volume increases were driven entirely by fleet purchases, which rose by 50.6% as buyers were drawn to the advanced technology, outstanding performance, reduced environmental impact and compelling tax incentives. Conversely, private BEV registrations fell -14.3% with less than one in 10 private new car buyers opting for electric during the month. Such a decline underlines the importance of providing these motorists with purchase incentives and other mechanisms to stimulate demand.

Despite an end of sale date now aligned with other major markets, the UK still has the most challenging zero emission vehicle (ZEV) transition timeline. The recently published Zero Emission Vehicle Mandate requires ZEVs to comprise half of each manufacturer’s new registrations within five years, and 80% by 2030. Achieving this will depend on private buyers making the transition, along with business and fleet customers. However, unlike in the other major markets working towards a 2035 end of sale date, UK private motorists have no purchase incentive to encourage them to invest in electric mobility.3

Mike Hawes, SMMT Chief Executive, said, “A bumper September means the new car market remains strong despite economic challenges. However, with tougher EV targets for manufacturers coming into force next year, we need to accelerate the transition, encouraging all motorists to make the switch. This means adding carrots to the stick – creating private purchase incentives aligned with business benefits, equalising on-street charging VAT with off-street domestic rates and mandating chargepoint rollout in line with how electric vehicle sales are now to be dictated. The forthcoming Autumn Statement is the perfect opportunity to create the conditions that will deliver the zero emission mobility essential to our shared net zero ambition.”

Stuart Masson, Editorial Director at The Car Expert, said: “While it is positive to see sales to fleets and business thriving, we have a government which is determined bash EVs in public while also requiring manufacturers to sell more of them. This is not a coherent strategy which will support consumers and businesses – it is thoroughly confusing and counterproductive.

“As a nation, we should not be left on the hard shoulder when it comes to electrification. We should remain in the fast lane and start harnessing our potential to lead in this sector while also giving car buyers more support, education and encouragement.”

“The government’s anti-EV messaging is driving customers away from some of the best new cars on the market, yet it still expects those customers to buy significantly more EVs in just three months’ time.”

“We need a measured and consistent approach from government rather than U-turns for short term political gain. This approach does not benefit consumers or businesses and probably isn’t a vote winner either.”

David Borland, EY UK & Ireland Automotive Leader, comments: “The UK’s motor industry continues to deliver significant growth, with September seeing a 21% year-on-year increase in registrations and the 14th consecutive month of growth. As in previous months, the growth was largely driven by increases in fleet, which saw growth of almost 41%, but retail also had an improvement of almost 6%, which could be expected in a plate change month.

“The increases were also balanced across the powertrain mix, with hybrids in particular performing well. On the supply side, despite a 9.7% decrease in volume in August, the overall performance so far in 2023 points to favourable conditions for the UK automotive sector. The UK also overtook France this September to become the world’s 8th largest auto manufacturing industry.

“However, the UK government’s decision to move the Internal Combustion Engine (ICE) sales ban from 2030 to 2035 was a significant and unexpected move in the context of the UK’s Electric Vehicle (EV) transition. The shift in policy may have a negative impact on consumer demand for EVs in the short term, as well as potentially affecting demand from fleet operators as both groups work out what the changes mean for them. There is a risk that, with Original Equipment Manufacturers (OEMs), retailers and charge point operators all having invested significant capital in anticipation of a 2030 ICE sales ban, the policy shift could see supply outstripping demand – a concern given the fact residual values of EVs are already facing challenges.

“Meanwhile, the proposed Zero Emissions Vehicle (ZEV) Mandate trajectory and targets for cars starting in 2024 will be implemented as planned. This could cause a market imbalance that will likely manifest in Q4, as manufacturers manage the product portfolio to minimise non-compliance in 2024.

“In the used car market, values fell by 1.9% at the three-year, 60,000-mile point in September, marking the largest monthly fall since 2008. Although the industry is undergoing a realignment, falls in value have been consistent for the past three months. However, analysts predict higher used car sales volumes in October as fleet returns and part-exchanges become more plentiful. Indeed, the likelihood of used ICE values at least holding steady, if not increasing, appears high following the Government’s recent announcements – although the impact on used EV residual values appears less certain.”

Manu Varghese, from EY’s UK & Ireland Advanced Manufacturing & Mobility Team, adds: “The automotive sector in the UK received some positive news recently, as new investments were announced in Somerset, Oxford, Swindon, and Ellesmere Port. There is also continued interest from overseas investors in UK car dealers, with the UK considered a market that adapts well to new models and changing consumer habits. On the flip side, there is still concern over the impact of Brexit tariff barriers on the industry’s economic viability. To ensure further growth and investment security, the UK’s automotive sector needs a stable environment to operate in.

“The UK’s automotive sector has shown pleasing resilience in light of recent positive developments such as new factory investments and significant plans for battery production. Indeed, the future looks bright for the sector, with growing optimism that the industry will continue to thrive in the coming years, despite mounting challenges as a result of changing regulation.”

John Wilmot, CEO, car leasing comparison website LeaseLoco, comments: “Private sales of battery electric vehicles (BEVs) experienced a slowdown last month, while corporate registrations remain the primary driver of growth in the electric car market.

“The government faces a significant challenge in addressing this decline.

“The substantial initial cost of electric vehicles remains an insurmountable obstacle for many private drivers eager to make the transition.

“There is an urgent need for financial incentives designed to make electric cars more accessible to those who cannot take advantage of salary sacrifice schemes and corporate discounts.

“Currently, only company directors and employees with access to salary sacrifice can benefit from the 2% benefit-in-kind taxation rate.

“We need a more level playing field. Financial fairness should be extended to all, not just a select few, and if the government is committed to achieving net-zero emissions, addressing this issue is crucial.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said: “Pent up demand for new vehicles, alongside the arrival of the new ‘73’ plates have helped car sales grow in September.

“While electric vehicles (EV) continue to show steady growth, data suggests the majority of sales this year have been driven by fleet transition to electric, not private sales. Lack of access to off-street parking and private charge points are currently significant barriers for consumers looking to purchase EVs.

“Deloitte’s upcoming Consumer Tracker report will show that only 27 per cent of consumers would consider purchasing a new or used battery electric vehicle (BEV) as their next car. In contrast, amongst consumers who either already have access to a private charging point, or have access to off street parking, suitable for the installation of a charging point, 40 per cent would consider purchasing a BEV as their next vehicle.”

Nick Williams, Managing Director, Lex Autolease, part of Lloyds Banking Group said: “Moving forward on phasing out the sale of new petrol and diesel cars and vans between 2024 and 2030 will provide consumers and businesses with the certainty needed to switch to EVs. That confidence coupled with the new registration plate release is reflected in strong September figures from the SMMT, which saw a further 272,610 new vehicles join the UK’s roads.

“I’m hopeful that the delay on the final phase out date won’t impact these figures in the coming years, as renewed commitments from manufacturers and businesses looking to hit their own carbon targets will help to drive continued growth.

“The revised deadline and the commitment to the ZEV mandate provides both clear, long-term policy support and the appropriate sense of urgency and should ensure industry, businesses and consumers can continue to plan effectively for an electric future.”

Mark Oakley, Director of AA Cars, comments: “September’s arrival of the new ‘73 registration plates helped the new car market extend its unbroken run of increasing sales to an impressive 14 straight months.

“Demand is holding up well despite the financial challenges households are facing, with many drivers who’d been waiting to upgrade or replace their old car choosing to do so as the new plates came in.

“The supply problems of last year are thankfully in the rear view mirror now. A host of attractive new models have come onto the market in recent months, and 12% more cars rolled off the UK’s production lines in August compared to the same month last year.

“For now it’s too early to gauge what impact, if any, the Government’s decision to push back the upcoming ban on the sale of new petrol and diesel cars will have on demand.

“Either way, greater choice and increasing competition between EV manufacturers continue to drive up sales of new electric models – which were up 18.9% year on year in September.

“This in turn is boosting supply in the used car market, as more second-hand and nearly-new EVs appear on dealers’ forecourts and provide a more affordable option for drivers who are looking to go green.”

Jon Lawes, Managing Director at Novuna Vehicles Solutions, comments: “The UK Government has been sending mixed messages about its net-zero policy and the decision to scrap HS2 will fuel concerns about its commitment to long-term infrastructure investment, a key pillar of the EV transition.

“High-speed charging access and grid capacity is a persistent challenge. The launch of the UK’s largest charging hub in Birmingham is a positive sign and shows corporates are ready to embrace the transition. However, this needs be matched by ambitious policymaking on critical infrastructure to give businesses and consumers confidence in EV adoption.”

1 September 2020: 328,041

2 September 2019: 343,255

3 ACEA: Electric cars: Tax benefits and purchase incentives