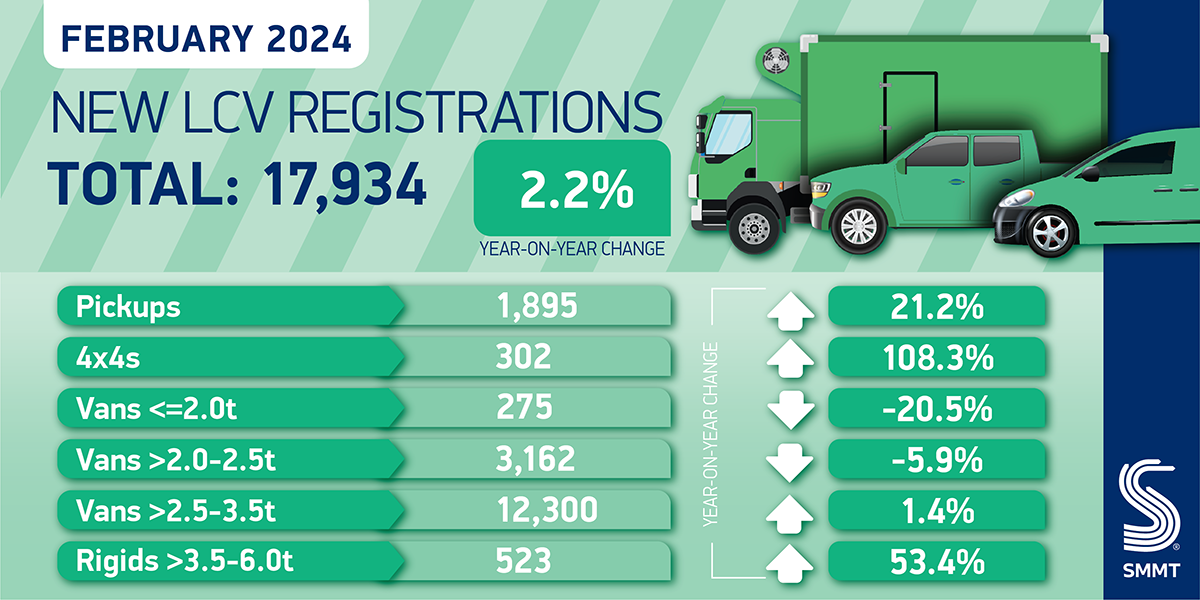

UK demand for new light commercial vehicles (LCVs) grew by 2.2% in February to 17,934 units, marking 14 months of consecutive growth, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). While February is traditionally a lower volume month, as many operators delay procurement until March for the new numberplate, the increase represents the best February performance since 1998.1

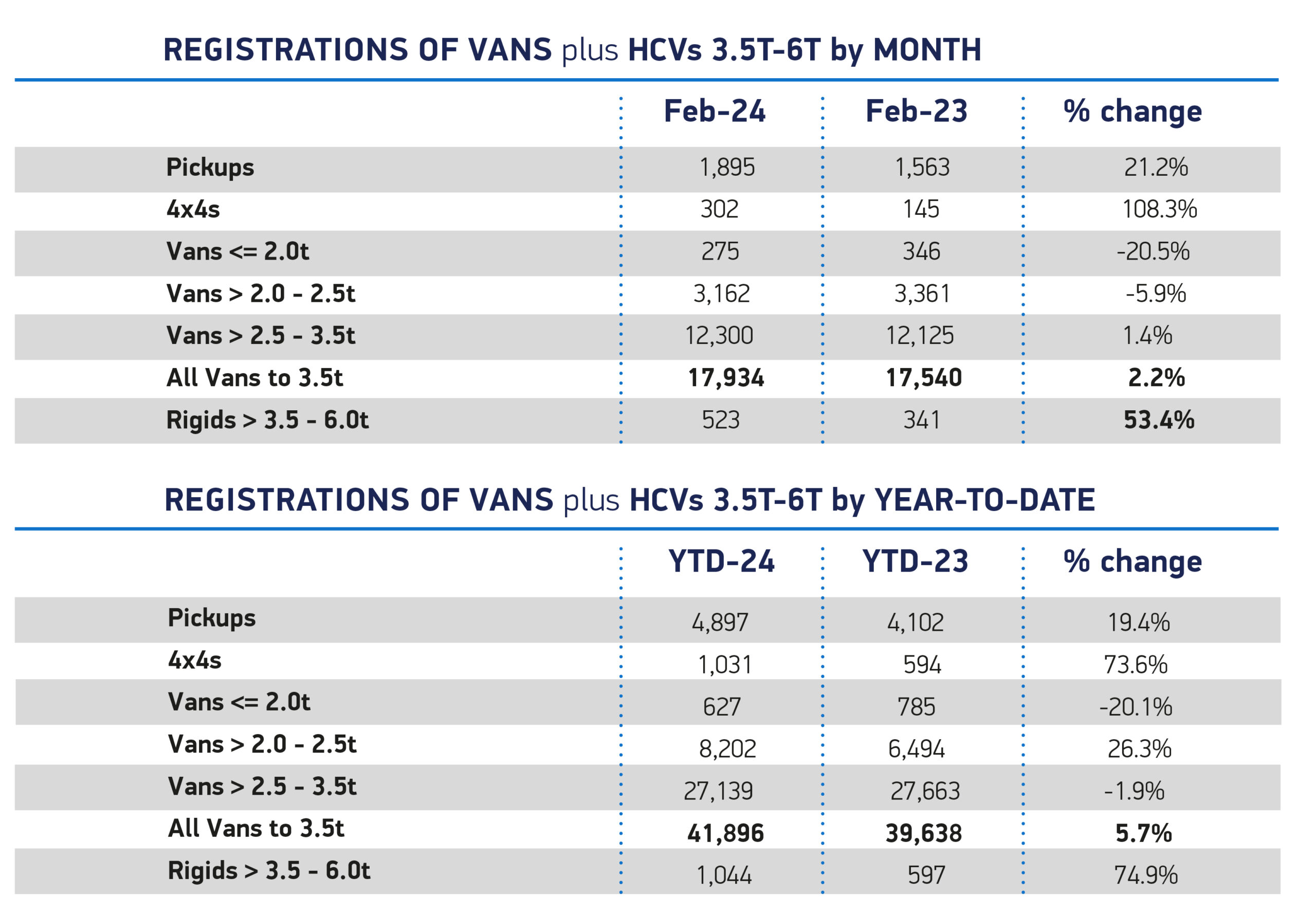

Registrations of vans weighing greater than 2.5 to 3.5 tonnes rose by 1.4% to 12,300 units, representing almost seven in 10 (68.6%) of all new vans as the trend for larger units continues. Deliveries of small vans weighing up to and including 2.0 tonnes, and medium-sized vans weighing greater than 2.0 to 2.5 tonnes, both saw declines, falling by -20.5% to 275 units and -5.9 % to 3,162 units respectively.

The smaller volume 4×4 segment saw registrations more than double, rising by 108.3%, while pickups, crucial for many rural and construction business operations, were the third most popular class of commercial vehicle after heavy and medium vans, with registrations rising 21.2%. Fleet renewal is crucial for decarbonisation, and the government’s recent decision to scrap changes to double cab pick-up vehicle taxation will ensure that operators can continue to invest in newer, lower emission models. The sector believes that it would be fairer and simpler to use a vehicle’s type approval as the basis to define it as a car or commercial vehicle for all tax purposes.

The smaller volume 4×4 segment saw registrations more than double, rising by 108.3%, while pickups, crucial for many rural and construction business operations, were the third most popular class of commercial vehicle after heavy and medium vans, with registrations rising 21.2%. Fleet renewal is crucial for decarbonisation, and the government’s recent decision to scrap changes to double cab pick-up vehicle taxation will ensure that operators can continue to invest in newer, lower emission models. The sector believes that it would be fairer and simpler to use a vehicle’s type approval as the basis to define it as a car or commercial vehicle for all tax purposes.

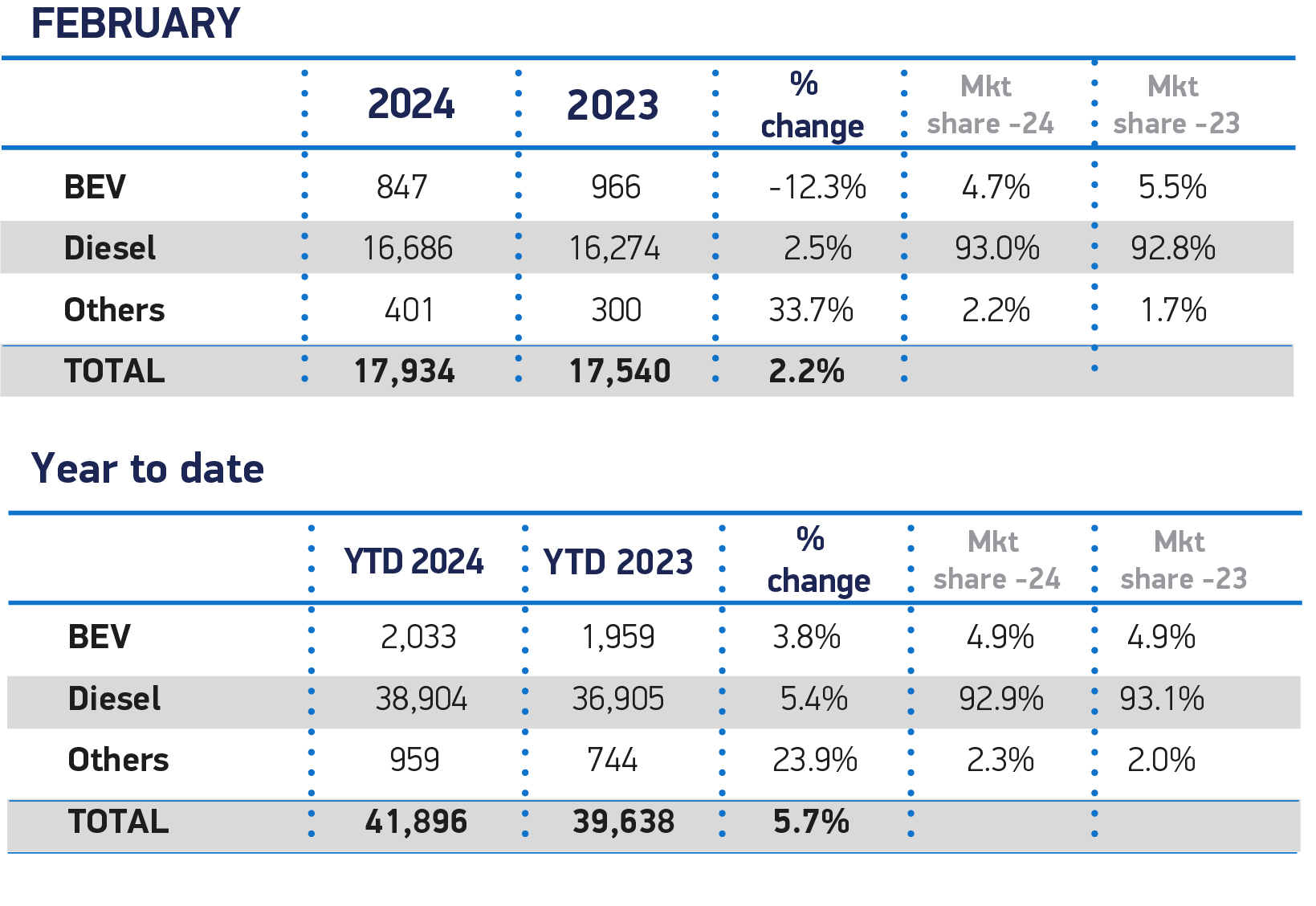

With each manufacturer now mandated to achieve a minimum proportion of zero emission registrations every year, February saw a decline in registrations of battery electric vans weighing up to 3.5 tonnes, falling by 119 units to 847 units, and taking a 4.7% market share, down from 5.5% a year ago. Maintaining existing purchase incentives and ensuring chargepoint rollout – including van-specific charging infrastructure – will be essential to help raise demand to the level needed to deliver net zero rapidly.

Mike Hawes, SMMT Chief Executive, said, “Britain’s appetite for new vans remains undiminished with 14 months of growth and, with last month’s rethink of taxation for pick-ups, expansion looks to be sustained. However, this growth and confidence must be translated into zero emission vehicles if we are to deliver our green goals. Maintenance of essential incentives and a ramp up of dedicated van-suitable chargepoint installation will be vital if we are to help keep long-term, net zero fleet investment moving forward at the pace needed.”

“The light commercial market is a good barometer of the state of the economy, and it is positive to see the market deliver its best February performance in 26 years” said Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK commenting on the latest SMMT’s new van registration figures.

In February, Light Commercial Vehicle (LCV) dealers registered a total of 17,934 new vans and light commercials, a modest increase of 2.2%. This is the fourteenth consecutive month of registration growth.

For 2024, year-to-date figures reveal 41,896 new LCVs are on the road this year, an increase of 5.7%.

The light and mid-weight sectors of LCVs decreased, with small vans up to 2.0 tonnes down -20.5% and mid-size LCVs 2.0-2.5t decreasing to 3,162 units from 3,361 units, a -5.9% decrease. The heavier, and most popular sized vans (2.5-3.5t) rose to 12,300 units from 12,125 units, a 1.4% increase.

February’s registration figures experienced a decrease in the number of battery electric commercials registered, down -12.3% to 847 units. Whilst the volume for EV vans has increased to 2,033 units this year (3.8% change year to date), it still only represents 4.9% of the volume of the total market share, equal to last year’s market share.

Sue Robinson added: “It is concerning to see sales of electric in the light commercial market remain at 4.9%, same to the market share from this time last year.

“With the impact of the ZEV mandate requiring 10% of LCVs sold in 2024 to be electric, there needs to be more impetus from the Government to create financial incentives to encourage van buyers to make the switch.

“Tomorrow’s Spring Budget provides an ample opportunity for the Government to address this. NFDA has repeatedly called for the introduction of price incentives to increase consumer confidence in EVs, notably in NFDA’s Spring Budget Submission.”

1 LCV February registrations 1998: 18,044 units.