The UK new car market rose 1.0% in the key ‘74’ plate change month of September, to 275,239 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). In what is traditionally a bumper month for new car registrations, second only to March, the performance was the best since 2020, but still -19.8% off pre-Covid September 2019.1

Growth was driven by fleet purchases, up 3.7% to 149,095 units and representing 54.2% of the overall market. Private consumer demand fell, by -1.8% to 120,272 units, accounting for 43.7% of registrations, while the smaller business sector saw volumes fall -8.4% to 5,872 units.

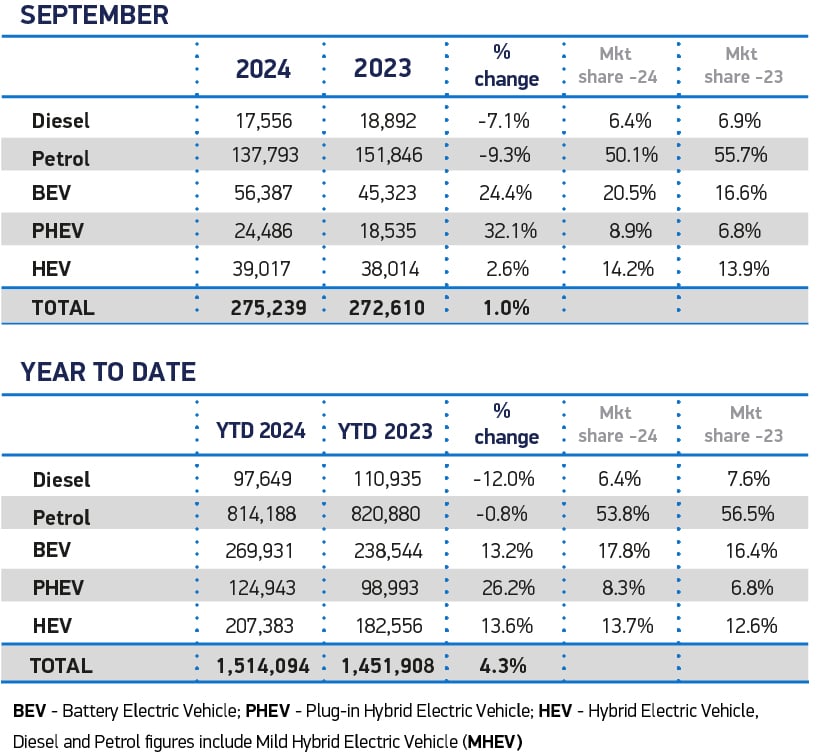

Uptake of plug-in hybrids (PHEV) grew faster than any other fuel type in the month, up 32.1% to take an 8.9% share of the market. Hybrid electric vehicle (HEV) registrations rose 2.6%, boosting market share to 14.2%, while petrol and diesel registrations declined by -9.3% and -7.1% respectively, although together they were still the choice of 56.4% of buyers in September.

Uptake of plug-in hybrids (PHEV) grew faster than any other fuel type in the month, up 32.1% to take an 8.9% share of the market. Hybrid electric vehicle (HEV) registrations rose 2.6%, boosting market share to 14.2%, while petrol and diesel registrations declined by -9.3% and -7.1% respectively, although together they were still the choice of 56.4% of buyers in September.

Demand for the latest battery electric vehicles (BEV) hit a new record volume for any month in September, up 24.4% to 56,387 units, achieving a 20.5% share of the overall market, up from 16.6% a year ago. This was not enough, however, to shift market share significantly, which edged up from 17.2% in the first eight months, to 17.8% from January- September. It is expected to reach 18.5% by the end of the year.

Fleets drove much of this growth, with deliveries rising 36.8% to account for more than three quarters (75.9%) of BEV registrations. Private BEV demand also rose, up 3.6% after unprecedented manufacturer discounting, but this was equivalent to just 410 additional registrations. Consumer demand for diesel grew at a faster rate, increasing 17.1% in September – a volume uplift of 1,367 units.

Year-to-date private BEV demand remains down -6.3% – underlining the scale of the challenge involved in moving the mass market to meet the mandated targets that were conceived in very different economic, geopolitical and market conditions. Previous assumptions of a market delivering steady BEV growth, cheaper and plentiful raw materials, affordable energy and low interest rates have not come to fruition, with the upfront cost of BEV models remaining stubbornly high. Added to this is consumers’ lack of confidence in the UK’s charging provision – despite recent investment and growth – which still acts as a barrier to BEV take up.

In an effort to offset this underlying paucity of demand, SMMT calculates that manufacturers are on course to spend at least £2 billion on discounting EVs this year.2 Given the many billions already invested to develop and bring these models to market, the situation is untenable and threatens manufacturer and retailer viability. For this reason, SMMT and 12 major vehicle manufacturers representing more than 75% of the market, have today written to the Chancellor calling for measures to support consumers and help speed up the pace of the EV transition. These include:

- Temporarily halving VAT on new EV purchases to put more than two million new ZEVs (rather than petrol or diesel) on the road by 20283

- Scrapping the VED ‘expensive car’ tax supplement for ZEVs, due next year, to avoid penalising buyers

- Equalising VAT on public charging to match the 5% home charging rate, and mandating infrastructure targets to support those who cannot charge at home

- Maintaining and extending the business incentives that are working, including Benefit in Kind which supports company cars and those on salary sacrifice schemes, and the important Plug-in Van Grant

Mike Hawes, SMMT Chief Executive, said, “September’s record EV performance is good news, but look under the bonnet and there are serious concerns as the market is not growing quickly enough to meet mandated targets. Despite manufacturers spending billions on both product and market support – support that the industry cannot sustain indefinitely – market weakness is putting environmental ambitions at risk and jeopardising future investment.

“While we appreciate the pressures on the public purse, the Chancellor must use the forthcoming Budget to introduce bold measures on consumer support and infrastructure to get the transition back on track, and with it the economic growth and environmental benefits we all crave.”

Russell Olive, UK Director, vaylens comments: “The launch of the new number plate turbo-charged car registrations in September. And many manufacturers and showrooms will be pleased that the heavy investment in electric vehicle technology and models is paying off – demand for the latest battery electric vehicles rose by 24.4%, accounting for 20.5% of the market in September.

“However, momentum continued to be largely driven by strong demand from fleets. New car registrations for zero emissions vehicles by private buyers only rose by 3.6%. To remain on track with the ambitious timeline for decarbonising transport, concerns about affordability and range anxiety need to be urgently addressed.

“The upcoming Autumn statement will provide an opportunity to outline the incentives and policies that will make a mass market transition to e-mobility successful. But the focus needs to move beyond just installing more change points. Bringing together control of charging infrastructure and payments to deliver a seamless, future-proof EV experience will reassure drivers about the road ahead.”

Gerry Keaney, BVRLA Chief Executive said: “September’s figures show that BEV registrations have gained some much-needed momentum, on the back of heavy discounting from manufacturers and sustained investment from business fleets.

“This growth is welcome but will remain unstable and unsustainable unless the Government comes up with a long-term strategy for supporting the BEV market towards its ambitious ZEV Mandate and Phase Out targets.

“Collapsing used BEV values – down 60% over two years and forecast to continue falling – have already led to an anticipated loss of 220,000 new EV sales. That ground now needs to be made up. Falling used values are eroding the confidence of fleet buyers and making the most popular way of financing a new electric car more expensive.

“We need used EV-targeted grants, tax incentives and a confidence-building communication campaign to boost retail demand and stabilise prices.”

Commenting on the SMMT’s September 2024 new car registration figures (Friday 04 October 2024), Jon Lawes, Managing Director at Novuna Vehicle Solutions, one of the UK’s largest fleet operators, said: “Despite an uptick in EV uptake last month following the number plate change driven by fleets, sustained momentum to attract the personal leasing sector relies on making the switch more accessible, starting with this month’s Budget as the first real test of the new government’s commitment to the transition.

“Building a stronger second-hand marketplace by boosting demand for used EVs is one of the key areas which must be addressed to achieve the EV transition at scale. It’s vital policymakers take bold action to reinforce business and consumer confidence in the long-term feasibility of the EV ecosystem.”

Christine Hart, Legal Director at independent law firm Brabners, said: “A strong September for new car sales more than made up for August’s traditional slowdown, as car enthusiasts held out for the new 74 plate registration to make its debut.

“But while a record month for electric vehicle registrations is encouraging to see, UK carmakers and dealerships are still relying heavily on fleet sales to shift EVs, as demand among private buyers remains subdued. Indeed, European battery maker Northvolt’s recently announced restructuring is a good indicator of fragility within the market.

“Closer to home, fresh clarity from the government that new hybrid car sales will be allowed until 2035 should give manufacturers and dealers the certainty needed to continue phasing out fully petrol and diesel cars from their order books. With the government’s first Budget around the corner, many will be hoping to see further commitments towards improving charging infrastructure to further stimulate consumer demand.”

1 343,255 registrations September 2019

2 £2 billion based on average discount reported by Auto Trader on BEVs in September of 12.1% as proportion of average retail price of a new BEV (£49,600, based on JATO data) multiplied by SMMT’s full year BEV market outlook of 364,000 units. To note this does not include finance offers or incentives given to large fleets

3 SMMT calculations