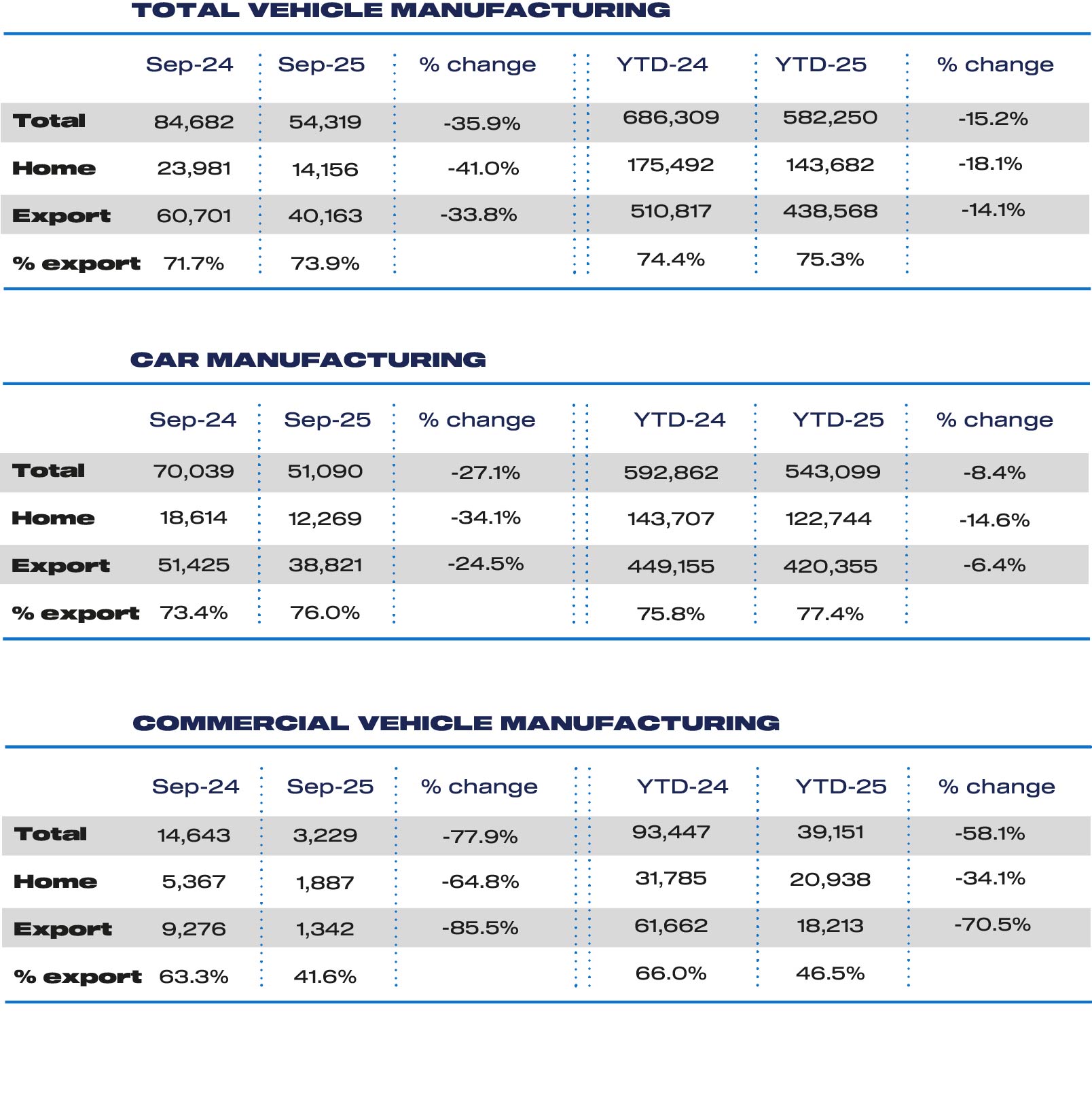

UK car production fell -27.1% in September, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 51,090 units left factory gates, with the production stoppage at Britain’s biggest automotive employer, Jaguar Land Rover – caused by an unprecedented cyber incident – largely responsible for the decline as other volume manufacturers reported growth.

Almost half (47.8%) of cars made in the month were either battery electric, plug-in hybrid or hybrid, with volumes up 14.7% to 24,445 units. Overall car production for the UK market fell by -34.1% to 12,269 units while exports declined -24.5%. 38,821 cars were made for global markets – representing 76.0% of total output – with the EU, US, Turkey, Japan and South Korea the top five destinations.

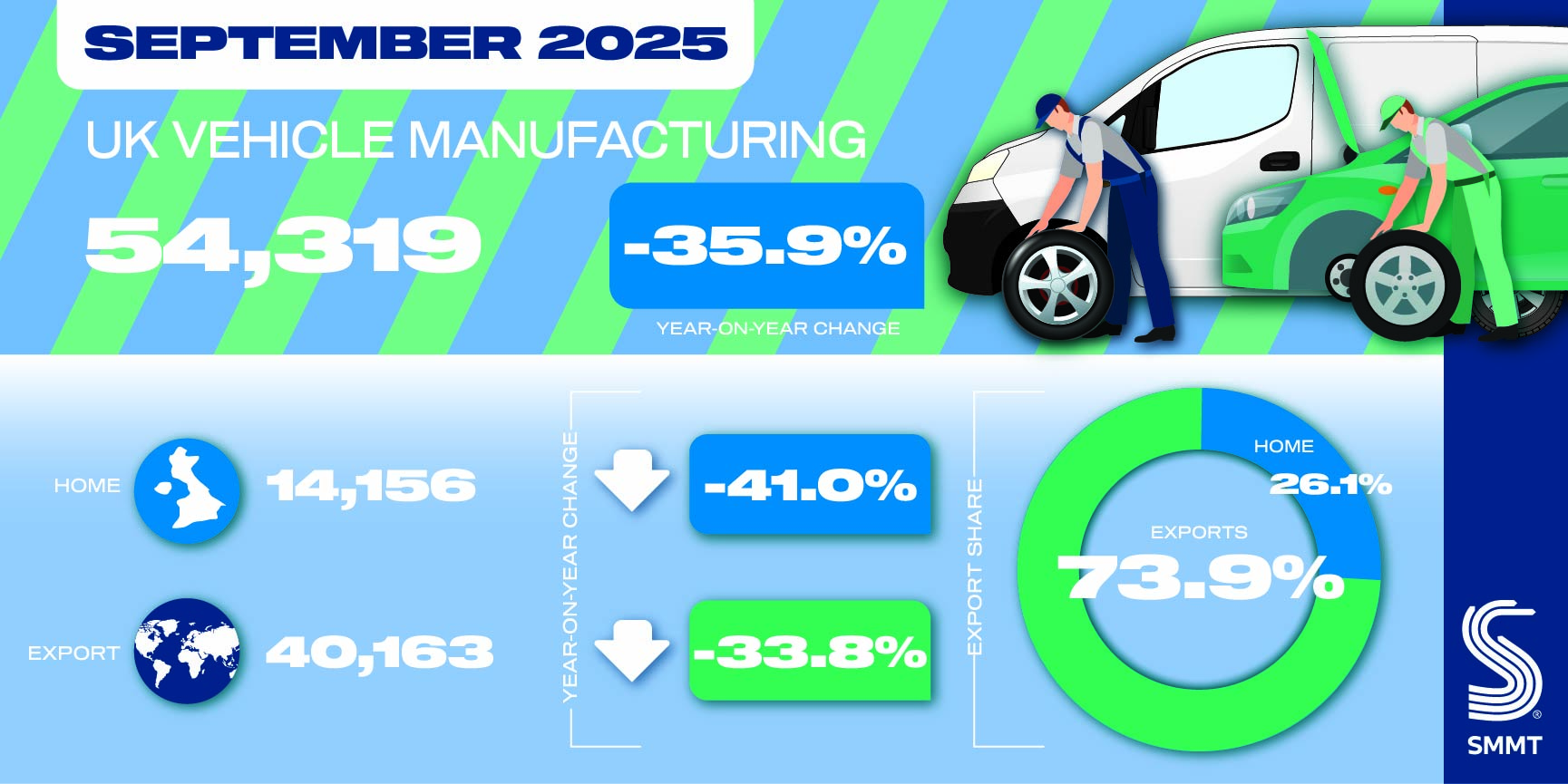

Commercial vehicle (CV) production, meanwhile, declined for the sixth month in a row, by -77.9% to 3,229 units, driven by the consolidation of operations by a leading manufacturer. Combined car and van production, therefore, was down by -35.9% in September to 54,319 units.

The news comes ahead of the Budget on 26 November and as the industry calls on the Chancellor to re-align fiscal measures with pro-growth policies that support the government’s Modern Industrial Strategy. The sector is warning of severe and lasting damage to jobs and the industry’s competitiveness if the Chancellor pushes ahead with plans to end critical Employee Car Ownership Schemes (ECOS). These schemes are an important part of manufacturer remuneration packages, allowing employees to access the products they make and sell affordably – yet government intends to reclassify ECOS vehicles to make them liable for company car tax, putting them out of reach for most automotive workers.

New analysis by SMMT reveals that 60,000 automotive manufacturing workers could be affected, cutting the value of their remuneration and leaving them without personal transport.1 The impact will be especially severe for factory employees in regions lacking adequate public transport, making it more difficult to work flexible shift patterns and more challenging to recruit people into a sector already suffering a skills shortage.

New analysis by SMMT reveals that 60,000 automotive manufacturing workers could be affected, cutting the value of their remuneration and leaving them without personal transport.1 The impact will be especially severe for factory employees in regions lacking adequate public transport, making it more difficult to work flexible shift patterns and more challenging to recruit people into a sector already suffering a skills shortage.

The impacts would spread even wider, with 80,000 fewer new car sales per annum, irrevocable damage to the nearly new and used markets, and an equally significant reduction in UK production volumes of up to 20,000 cars. Such a reduction would amount to a loss of more than £1 billion in revenue, putting some 5,000 manufacturing jobs at risk, and a near half billion-pound hit to government finances from lost VAT and Vehicle Excise Duty receipts.2

Mike Hawes, SMMT Chief Executive, said, “September’s performance comes as no surprise given the total loss of production at Britain’s biggest automotive employer following a cyber incident. While the situation has improved, the sector remains under immense pressure. The Industrial Strategy, launched by the Prime Minister, Business Secretary and Chancellor only in June, sought to align government policies towards growth and restore UK vehicle output to 1.3 million units per annum. The move to scrap ECOS immediately puts that ambition in doubt and must be reversed given the damage it will inflict on the sector and exchequer revenues.”

Paul Holland, Managing Director for UK/ANZ Fleet at Corpay, including UK brand, Allstar, commented: “The Autumn Budget is meant to be about stability and growth, but small fleets and van drivers are bracing for another round of cost increases. These are the people who keep Britain moving. They deliver our groceries, fix our boilers, keep the shelves stocked. Yet every Budget seems to treat them as an easy target. Fuel duty, taxes, higher wages, energy costs – all of it lands on small operators first, and they have the least room to absorb it.

“The reality is that small businesses don’t have corporate buffers or deep pockets. They are family businesses, sole traders, and local employers. Every extra pound squeezed out of them is another pound that ends up in the weekly shop or the cost of a delivery. And while larger fleets can plan years ahead, the small firms are often making decisions month to month. They need breathing space, not another set of hidden costs.

“This is why the Budget matters. The Government can choose to pile more weight onto these businesses, or it can give them the room to invest and grow. That means phasing in new taxes, offering SME-friendly incentives for EV adoption, and making infrastructure accessible beyond the big corporates. The van driver in Manchester or the builder in Birmingham deserves the same chance to go greener and save money as the multinational.

“If the Chancellor really wants a healthier economy, the Autumn Budget cannot ignore the backbone of UK business. Stop treating small businesses like an ATM. Give them the stability they need, and the whole country will feel the benefit.”

Amid an incredibly challenging global industrial and investment landscape, UK car and van factories turned out a combined 582,250 units this year, representing a -15.2% decline on the equivalent period in 2024. The industry, therefore, is calling for rapid interventions to shore up its competitiveness. Keeping manufacturers’ ECOS schemes would support manufacturing workers and investors and would be an immediate relief, while pulling forward to 2026 critical energy cost interventions – notably the British Industrial Competitiveness Scheme (BICS) – combined with skills funding reforms and programmes to support supply chain resilience would further boost the sector.

1 SMMT member survey, October 2025

2 SMMT calculations based on survey results, including an 80,000-unit decline in ECOS volumes and corresponding VAT and VED losses, and a 3% decline in manufacturing jobs (equivalent to more than 5,000 of the UK’s 183,000 auto manufacturing jobs)