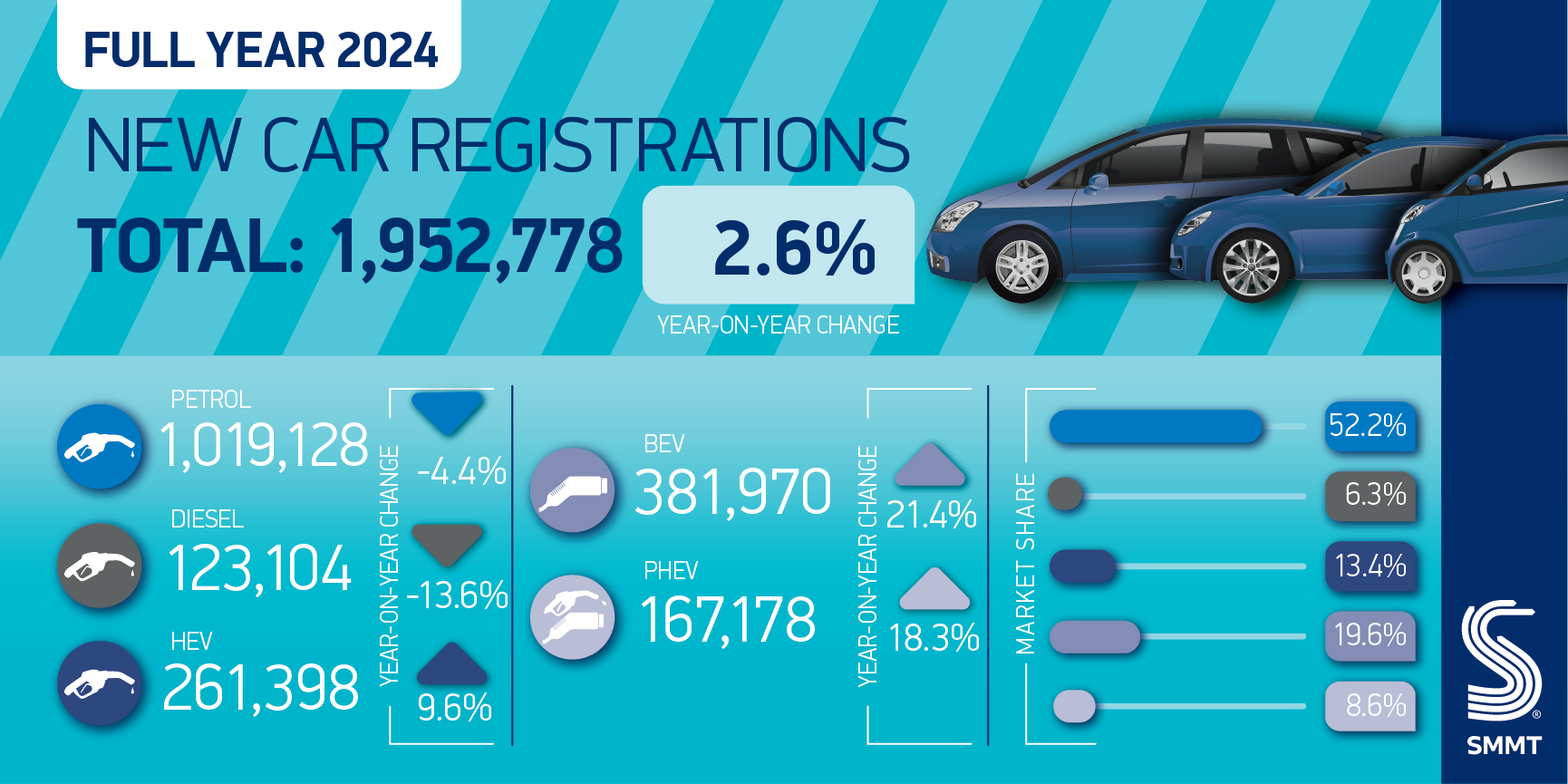

The UK new car market recorded its second successive year of growth with 1,952,778 new cars reaching the road in 2024 – a rise of 2.6% on the previous year, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). In the final month of the year, the market remained flat at 140,786 units, a marginal -0.2% decline, capping off a challenging year for the sector as manufacturers strove to create demand for electric vehicles in a bid to meet new mandated sales targets.

Over the full year, growth was delivered entirely by fleets, up 11.8% to reach 1,163,855 units, accounting for a record six in 10 (59.6%) new car registrations. Conversely, registrations by private buyers fell by -8.7% to 746,276 units – less than in 2020 when social distancing restrictions during the pandemic shut down the market for three months.1 The far smaller business sector saw uptake fall by -3.1% to 42,647 units.

The first year of mandated targets for new zero emission vehicles finished with another strong December performance, with 43,656 new battery electric vehicle (BEV) registrations accounting for 31.0% of the market – the highest since December 2022’s record 32.9%. As a result, BEVs made up 19.6% of the market (381,970 units) in 2024, up by more than a fifth (67,283 units) from last year, but short of the 22% demanded by the mandate.

Industry has pulled every lever to try and achieve this target, with manufacturer discounting totalling more than £4.5 billion in 20242, an amount that is not sustainable in the long term. Billions of pounds of investment in new technologies and products over the past decade have delivered a record 132 ZEV models to the UK market, up 38% since 2023 to account for a third of all models available, with an average range of almost 280 miles – more than two weeks’ of driving for most people.3

One of the major constraints to growth, however, has been lacklustre demand by private buyers, with only one in 10 choosing an EV in 2024. Petrol remained the most popular powertrain among these buyers, commanding 61.0% of demand, with hybrid electric vehicles (HEVs) in second place (16.0%). Conversely, around 64,000 more BEVs were registered by businesses and fleets than a year ago, with such vehicles representing a quarter (25.4%) of those segments’ registrations and demonstrating the effectiveness of the compelling tax incentives afforded non-private buyers.

Across the total market, pure petrol and diesel car registrations fell by -4.4% and -13.6% respectively as more buyers swapped either to BEVs, or to lower emission hybrid electric vehicles (up 9.6%) and plug-in hybrids (up 18.3%).

Consequently, average new car CO2 has fallen by -6.2% to 102.1g/km. While this will assist some manufacturers with mandate compliance, the extent to which it will help will remain unclear until confirmed baseline CO2 figures are provided by government. Meeting the mandate thresholds in 2025 will be even more intense as the target is now 28% – requiring an EV market uplift of just under 50%.

Action is needed now to amend the regulation to reflect the reality of a constrained market and ZEV demand failing to grow in line with expectations. When the previous government drew up plans for a mandate the 2024 BEV market was forecast to be almost 20% – or some 75,000 units – larger than has eventuated.4 With manufacturer support at record but unstainable levels, government must do more to stimulate private demand and challenge chargepoint operators to accelerate rollout, ensuring the UK has a reliable, affordable and comprehensive nationwide network of infrastructure that dispels any doubts potential EV buyers may harbour so ever more drivers will make the switch.

Mike Hawes, SMMT Chief Executive, said, “A record year for EV registrations underscores vehicle manufacturers’ unswerving commitment to a decarbonised new car market, with more choice, better range and increased affordability than ever before. This has come at huge cost, however, with the billions invested in new models being supplemented by generous incentives which are unsustainable. We need rapid results from the regulatory review and urgent substantive support for consumers – else automotive investments will be at risk and the jobs, economic growth and net zero ambitions we all share in jeopardy.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said: “The additional financial pressures of the festive period may have discouraged the purchase of big-ticket items, therefore affecting new car sales for December, but demand for electric vehicles remain strong.

“Looking ahead to 2025, the industry will be hoping for inflation and supply chain pressures to ease, not least because the heavy discounting incentives used to drive uptake over the last few months looks unsustainable.

“There is also hope within the industry that the government’s ongoing consultation on the Zero Emission Vehicle Mandate will provide much needed clarity and commitment. However, with the Zero Emission Vehicle target increasing to 28% in 2025 there will likely be greater pressure on manufacturers who are already under strain.

“Whilst the industry has invested heavily in electric vehicles, a successful transition requires a supportive policy environment. This includes not just providing clarity on 2030 targets, but also providing incentives to encourage adoption and addressing critical issues such as expanding and developing charging infrastructure. The next 12 months will be crucial for the sector as it navigates these challenges and opportunities.”

Jon Lawes, Managing Director at Novuna Vehicle Solutions, one of the UK’s largest fleet operators said: “An uptick in EV growth in December reflects the significant discounting by manufacturers to reach EV vehicle quotas. However, it remains clear that such incentives are unsustainable with the ZEV mandate unfit for purpose, and the challenges will only get worse with rising thresholds this year.

“There’s no doubt that the industry widely maintains support for the transition, but the government must act now to relieve pressure on manufacturers that are already stretched to hit overly ambitious targets by providing bold fiscal support over and beyond measures just for company car drivers. Any misalignments with the 2030 ICE phase-out timeline must also be ironed out urgently with a swift conclusion to the consultation – the status quo threatens to stifle the transition to zero emissions vehicles in the year ahead.”

Susan Wells, Director of EV & Solar at HIVE said: “2024 saw a record number of drivers investing in electric vehicles with registrations at an all-time high. New EV owners continued to realise the environmental and cost-saving benefits of switching away from a petrol or diesel vehicle and take advantage of the adoption incentives that exist across the market.

“With the phase-out of new petrol and diesel cars now just five years away, the demand for zero-emission vehicles will only intensify. Manufacturers are investing at unprecedented levels to meet this, but it’s only part of the puzzle. We must further accelerate the roll out of at-home and public charging infrastructure across the country to give drivers the confidence to charge whenever and wherever they want.

“The government will be closely considering how to shape the 2030 petrol and diesel car phase-out to pave the way for the work that’s needed.

“For now, industry leaders must continue to work together and ensure they have the workforce and resources to deliver on these net zero targets.”

1 Private registrations, 2020: 747,507

2 Alarm bells ringing as EV transition hits auto industry, 27 November 2024

3 Based on SMMT analysis

4 SMMT market outlook, released February 2023